Evolutionary Game Theory for Sustainable Energy Systems: Strategic Bidding, Carbon Pricing, and Policy Optimization for Clean Energy Development

Received: 30 June 2025 Revised: 21 August 2025 Accepted: 15 September 2025 Published: 11 October 2025

© 2025 The authors. This is an open access article under the Creative Commons Attribution 4.0 International License (https://creativecommons.org/licenses/by/4.0/).

1. Introduction

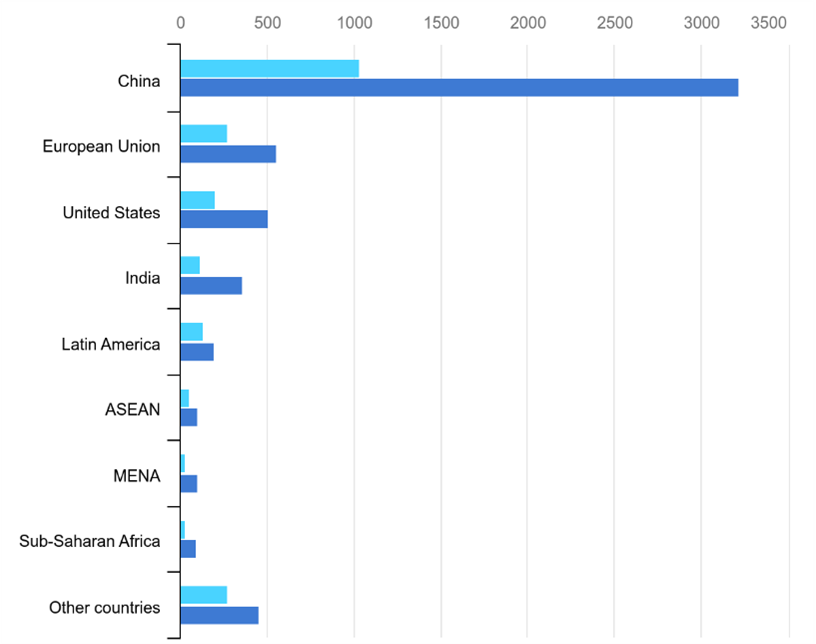

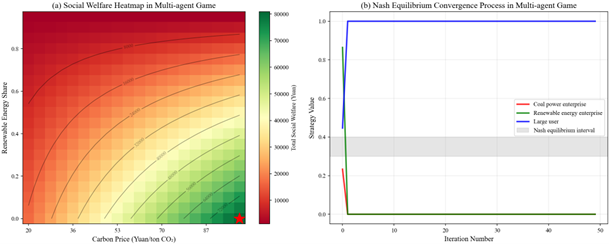

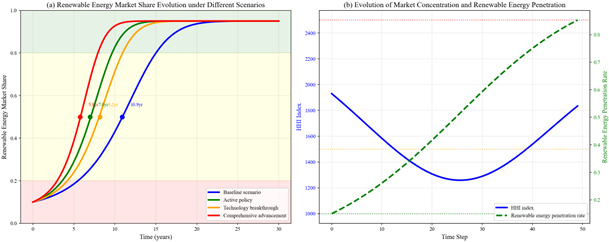

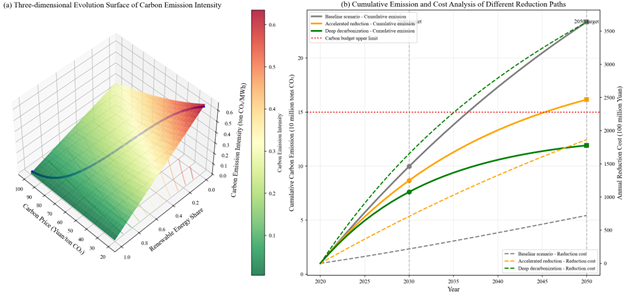

Since the 21st century, the global energy transition has emerged as a prominent trend. The dependence on traditional fossil energy has continuously decreased, while renewable energy sources such as wind and solar energy have witnessed robust development [1]. However, this transition has introduced unprecedented complexity in energy market operations, particularly regarding strategic interactions among diverse market participants under evolving carbon pricing mechanisms. The “World Energy Outlook” report by the International Energy Agency (IEA) shows that the proportion of fossil energy in global energy consumption has been declining year by year, whereas the share of renewable energy has been rising rapidly [2]. Despite extensive research in energy economics and game theory, the dynamic strategic behaviors of energy market participants under carbon constraints remain insufficiently understood, particularly regarding the long-term evolutionary patterns that emerge from repeated interactions among heterogeneous agents. Take the annual newly installed capacity of global renewable energy as an example. It has leaped from 666 gigawatts in 2024 to nearly 935 gigawatts in 2030 [3]. China has stood out in this process. As shown in Figure 1, its renewable energy capacity is expected to increase by more than 2500 gigawatts from 2017 to 2030, far exceeding that of the European Union (about 1500 gigawatts) and the United States (about 1000 gigawatts).

Figure 1. Regional analysis of renewable energy capacity expansion trajectories from 2017 to 2030, demonstrating China’s leadership in global clean energy development with projected capacity additions exceeding 2500 GW, compared to the European Union (1500 GW) and the United States (1000 GW). Data source: International Energy Agency World Energy Outlook 2024.

Multiple factors, including technological progress, cost reduction, and policy support from various countries drive the global energy transition. The signing of the Paris Agreement in 2015 demonstrated the firm determination of the international community to tackle climate change. Countries have successively set carbon neutrality goals. For instance, the European Union’s “Green New Deal” commits to achieving carbon neutrality by 2050, China plans to reach this goal by 2060, and the United States has also announced the achievement of net-zero emissions by 2050. To attain these goals, it is imperative to reduce the use of fossil energy and accelerate the development and utilization of renewable energy. Meanwhile, international climate agreements have promoted the widespread application of carbon pricing mechanisms, such as carbon trading and carbon taxes, which have profoundly transformed the cost structure and market competition landscape of the energy industry [4]. Renewable energy sources, especially wind energy, solar energy, and biomass energy, are of great significance for reducing greenhouse gas emissions and addressing climate change. With the continuous decline in the costs of wind and solar energy, they have become the core alternatives to fossil fuels. By 2050, renewable energy is estimated to meet two-thirds of the global energy demand and create enormous opportunities for economic growth and employment [5]. To realize this objective, it is necessary to accelerate the deployment of technologies and innovate policies, especially to improve the efficiency of power transmission, enhance the flexibility of the energy system, and boost energy efficiency. Therefore, renewable energy is not only the key to reducing carbon emissions but also an important driving force for global sustainable development.

However, the development of renewable energy does not proceed without obstacles. Its high investment cost and obvious intermittency of power supply pose challenges to the stable operation of the power system. For example, the issue of power stability has become more prominent, and the demand for energy storage technology has significantly increased [6].

Against this backdrop, the reform of the electricity market (EM) has become a crucial measure, covering aspects such as the restructuring of the market structure, the introduction of the wholesale market, and the transformation of regulatory approaches. For example, the electricity spot market and ancillary service market in Europe provide an important platform for the consumption of renewable energy, and the application of distributed energy trading and blockchain technology has brought new opportunities for the intelligent and decentralized development of the EM.

At the same time, the carbon pricing mechanism has changed the cost structure of power generation enterprises. Taking the European Union Emissions Trading System (EU ETS) as an example, the rise in carbon prices has significantly increased the cost of power generation from fossil energy, prompting enterprises to adjust their bidding strategies and shift towards clean energy power generation [7]. However, traditional bidding strategies have gradually revealed their limitations in a complex market environment. Static optimization methods are difficult to capture the dynamic changes in the market, and the single-agent decision-making model ignores the interactive competition among multiple agents. Therefore, it is urgent to introduce advanced dynamic game analysis methods. These methods can not only simulate the long-term behavior evolution of market participants but also provide a scientific basis for policy formulation and the optimization of bidding strategies.

Currently, existing research predominantly employs static game-theoretic approaches that fail to capture the dynamic evolutionary nature of energy market transitions under carbon constraints. Second, while carbon pricing mechanisms have been extensively studied in isolation, their integration with strategic bidding behaviors and multi-agent interactions remains superficially addressed. Third, the policy optimization aspects of energy market games, particularly the design of incentive mechanisms that promote sustainable energy transitions, have received inadequate attention in review literature. Fourth, the behavioral economics dimensions of energy market participants, including bounded rationality and learning dynamics, are largely overlooked in existing comprehensive reviews. Finally, the interdisciplinary integration of machine learning and real-time analytics with evolutionary game theory (EGT) approaches represents an entirely unexplored frontier in current review studies. These gaps collectively demonstrate the urgent need for a systematic review that bridges game theory, energy policy, and sustainability science through an evolutionary lens.

Despite the substantial body of research in energy economics and game theory, several critical gaps persist that limit our understanding of sustainable energy transitions. First, the dynamic strategic evolution of energy market participants under carbon pricing mechanisms lacks comprehensive theoretical frameworks that can predict long-term market behaviors and stability conditions. Second, the complex interdependencies between carbon pricing policies, renewable energy subsidies, and strategic bidding behaviors remain poorly understood, particularly regarding their combined effects on market efficiency and environmental outcomes. Third, existing models inadequately address the behavioral heterogeneity of market participants, failing to account for varying adaptation rates, risk preferences, and learning capabilities among different agent types. Fourth, the policy optimization dimension of energy market design has received insufficient attention, particularly regarding the sequential implementation of regulatory interventions and their dynamic effects on market evolution.

This review makes several distinctive contributions that advance the current state of knowledge in energy game theory and sustainability science. First, we provide the most comprehensive synthesis to date of EGT applications in energy systems, establishing a unified theoretical framework that bridges static optimization approaches with dynamic behavioral evolution. Second, we systematically analyze the strategic interactions between carbon pricing mechanisms and energy market bidding behaviors, revealing critical insights for policy optimization that have not been addressed in existing review literature. Third, we introduce novel perspectives on multi-agent cooperation and competition dynamics in carbon-constrained energy markets, providing theoretical foundations for understanding long-term market stability and transition pathways. Fourth, we comprehensively evaluate policy intervention mechanisms through an evolutionary lens, offering evidence-based recommendations for designing effective incentive structures that promote sustainable energy transitions. Fifth, we identify and articulate future research directions integrating machine learning, behavioral economics, and real-time analytics with EGT, establishing a roadmap for next-generation energy market analysis tools.

The remainder of this paper will provide a systematic and comprehensive analysis of EGT applications in sustainable energy systems. Section 2 examines carbon pricing mechanisms and EM bidding dynamics, establishing the foundational understanding of how carbon costs influence strategic behaviors and market clearing processes. This section analyzes both carbon tax and emissions trading systems, comparing their differential impacts on various market participants and their implications for bidding strategy optimization. Section 3 provides an in-depth exploration of EGT and its applications in power markets. It reviews theoretical foundations, methodological approaches, and empirical applications while identifying the unique advantages of evolutionary approaches over traditional static game models.

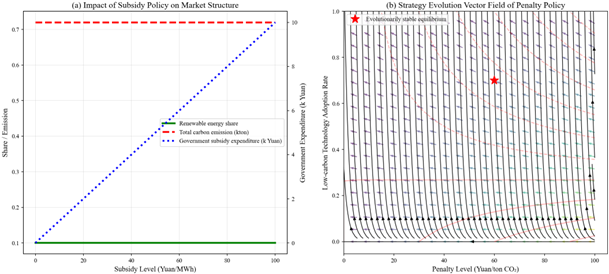

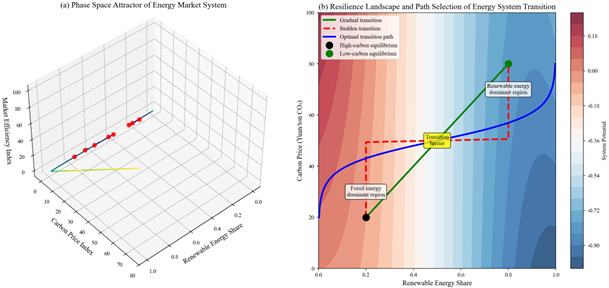

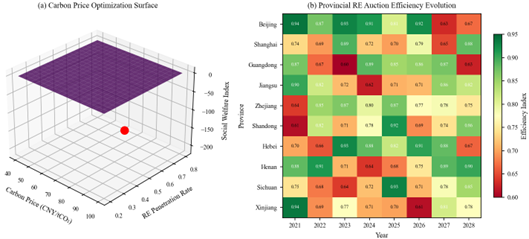

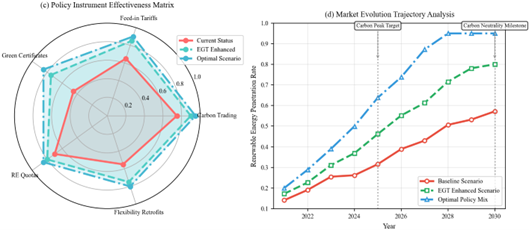

Section 4 presents the core analytical framework through evolutionary game modeling of bidding strategies under carbon pricing mechanisms, including comprehensive simulation analyses that demonstrate the dynamic evolution of market behaviors under various policy scenarios. This section integrates theoretical modeling with extensive computational experiments to reveal critical insights about market stability, convergence properties, and optimal policy configurations. Section 5 translates theoretical findings into practical policy implications for sustainable energy transition, providing evidence-based recommendations for policymakers regarding carbon pricing optimization, renewable energy support mechanisms, and market design principles.

Section 6 outlines future research directions and methodological advancements, identifying emerging opportunities for integrating machine learning, behavioral economics, and real-time analytics with EGT approaches. Finally, Section 7 synthesizes the key findings and contributions of this review, articulating the broader implications for energy policy, market design, and sustainability science while highlighting the transformative potential of evolutionary approaches for addressing complex energy transition challenges.

Overall, this comprehensive review holds profound significance for advancing theoretical understanding and practical applications in sustainable energy systems. Theoretically, our synthesis establishes EGT as a critical analytical framework for understanding complex energy market dynamics, providing researchers with robust methodological foundations for investigating strategic interactions under carbon constraints. The integration of behavioral economics insights with evolutionary approaches offers unprecedented opportunities for developing more realistic models of energy market participants, moving beyond the limitations of perfect rationality assumptions that have constrained previous research.

From a practical standpoint, our findings provide policymakers and industry stakeholders with evidence-based guidance for designing effective carbon pricing mechanisms, optimizing renewable energy support policies, and managing energy market transitions. The policy implications derived from evolutionary game analysis offer actionable insights for achieving climate objectives while maintaining market efficiency and economic stability. Furthermore, our identification of future research directions establishes a forward-looking research agenda that positions the academic community to address emerging challenges in energy system decarbonization through innovative interdisciplinary approaches. The prospective integration of machine learning and real-time analytics with EGT represents a paradigmatic shift toward intelligent, adaptive energy market management systems that can respond dynamically to technological innovations, policy changes, and environmental uncertainties. Thus, this review serves as a comprehensive state-of-the-art analysis and a catalyst for transformative research that will shape the future of sustainable energy systems.

2. Carbon Pricing Mechanisms and Electricity Market Bidding Dynamics

2.1. Theoretical Foundations of Carbon Pricing Mechanisms

Against the backdrop of the global community’s active response to climate change and its all-out efforts to promote carbon emission reduction, the carbon pricing mechanism has emerged as a crucial policy tool grounded in fundamental economic principles that address market failures inherent in environmental externalities. The theoretical foundation of carbon pricing rests upon the seminal work of Arthur Pigou, whose analysis of negative externalities demonstrated that market mechanisms alone cannot achieve socially optimal outcomes when production activities impose costs on third parties without compensation. Carbon emissions represent a quintessential example of such externalities, where the social costs of greenhouse gas emissions significantly exceed the private costs borne by emitting entities, necessitating corrective interventions to internalize these external costs and restore market efficiency [8].

The economic theory underlying carbon pricing mechanisms acknowledges that atmospheric carbon dioxide functions as a global commons, creating what Garrett Hardin conceptualized as a tragedy of the commons scenario where individual rational behavior leads to collectively irrational outcomes. This fundamental recognition has catalyzed the development of two primary regulatory approaches: direct price instruments through carbon taxation and quantity-based instruments through emissions trading systems. Both mechanisms operate on the principle of price discovery, albeit through different pathways that reflect distinct philosophical approaches to environmental regulation and market intervention.

Carbon taxation represents the most direct application of Pigouvian taxation theory, where governments impose levies proportional to the carbon content of fossil fuels or the emissions generated by industrial processes. This approach provides what economists term “price certainty” by establishing predetermined costs for carbon emissions, enabling enterprises to incorporate these expenses into long-term investment planning and operational decision-making frameworks [9]. The theoretical appeal of carbon taxation lies in its administrative simplicity and immediate price signal transmission, characteristics that align with neoclassical economic assumptions regarding rational actors responding predictably to price incentives. However, this approach exhibits what scholars have identified as “quantity uncertainty”, where the ultimate level of emission reductions remains contingent upon market responses to the imposed tax rates rather than predetermined environmental targets.

Conversely, emissions trading systems embody what economists describe as “cap-and-trade” mechanisms, establishing predetermined limits on aggregate emissions while allowing market forces to determine the optimal allocation of emission reduction efforts across participating entities. This approach draws theoretical inspiration from the Coase theorem, which posits that parties can negotiate efficient solutions to externality problems when property rights are clearly defined and transaction costs remain minimal [10]. The theoretical elegance of emissions trading lies in its capacity to achieve predetermined environmental outcomes at minimum economic cost by enabling entities with lower abatement costs to undertake proportionally greater emission reductions while selling excess allowances to entities facing higher abatement expenses.

The carbon trading mechanism represents a vanguard of emission reduction based on market mechanisms, with the EU ETS serving as the most prominent empirical manifestation of this theoretical framework. Since its launch in 2005, the EU ETS has been continuously optimized and improved, evolving into the world’s largest carbon trading market with the longest operating history [11]. This system brings numerous energy-intensive industries within the European Union under its regulatory purview. By setting a stringent cap on the total amount of carbon emissions and allocating carbon emission allowances to enterprises, it has established a comprehensive market value system for carbon emissions [10]. Under this system, enterprises that successfully control their emissions within allocated allowances through energy conservation and emission reduction measures can sell remaining allowances in the market and generate profits. Conversely, entities whose emissions exceed their allowances must purchase additional permits. Based on market supply and demand dynamics, this incentive and restraint mechanism has effectively stimulated enterprises’ enthusiasm for proactive emission reduction initiatives, thereby facilitating industries’ green and low-carbon transformation.

The theoretical sophistication of carbon pricing mechanisms extends beyond simple price-quantity relationships to encompass complex behavioral dynamics that influence strategic decision-making across multiple time horizons. Contemporary research has revealed that carbon pricing effectiveness depends on market participants’ expectations regarding future policy trajectories, technological developments, and regulatory stability [7]. This recognition has prompted scholars to examine carbon pricing through the lens of behavioral economics, acknowledging that real-world decision-makers exhibit bounded rationality, loss aversion, and temporal discounting patterns that deviate from theoretical assumptions of perfect rationality and complete information.

Furthermore, the integration of carbon pricing mechanisms with EM operations introduces additional theoretical complexities that necessitate sophisticated analytical frameworks capable of capturing multi-agent strategic interactions. The research conducted by Narassimhan et al. demonstrates that carbon pricing effectiveness varies significantly across different market structures, regulatory frameworks, and technological contexts [10]. These findings underscore the importance of understanding carbon pricing not merely as an isolated policy instrument but as a component of broader institutional arrangements that shape competitive dynamics and investment incentives within energy systems.

The theoretical foundations of carbon pricing also encompass critical considerations regarding distributional effects and equity implications that extend beyond pure efficiency calculations. Research examining income distribution effects reveals that carbon pricing mechanisms can exhibit regressive characteristics, imposing proportionally greater burdens on lower-income households and small enterprises with limited capacity for technological adaptation [12]. This recognition has prompted theoretical developments in environmental justice scholarship that seek to design carbon pricing mechanisms capable of achieving environmental objectives while maintaining social equity and economic fairness.

The temporal dimension of carbon pricing theory presents additional challenges related to dynamic efficiency and intertemporal optimization. Unlike static economic models that assume instantaneous adjustment to price signals, carbon pricing operates within complex systems characterized by significant capital stock turnover periods, technological learning curves, and institutional adaptation processes. This temporal complexity necessitates theoretical frameworks that can accommodate path dependence, technological lock-in effects, and the gradual evolution of market structures in response to sustained policy interventions.

Recent theoretical advances have also emphasized the importance of understanding carbon pricing within broader institutional economics and political economy frameworks. The effectiveness of carbon pricing mechanisms depends not only upon their technical design characteristics but also upon the broader governance structures, enforcement capabilities, and social acceptance that determine their implementation and long-term sustainability. This institutional perspective highlights the need for theoretical approaches to capture the co-evolution of carbon pricing policies with broader energy market institutions, regulatory frameworks, and societal values.

These theoretical foundations establish the conceptual groundwork for understanding how carbon pricing mechanisms interact with strategic behaviors in EMs, creating complex dynamics that require evolutionary game-theoretic approaches to fully comprehend the long-term adaptation processes that characterize energy system transitions under carbon constraints.

2.2. Comparative Analysis of Carbon Tax and Emissions Trading Systems

China’s carbon trading market is also developing steadily. Since the start of trading in 2021, key emission units in the power generation industry have been incorporated into it. In the future, more energy-intensive industries such as steel, cement, and the chemical industries will gradually be included. This move is playing an increasingly prominent role in promoting the green and low-carbon transformation of the economy [12]. On the other hand, the carbon tax mechanism directly taxes the carbon content or carbon emissions of fossil fuels instead of setting permitted emission levels [9]. This mechanism internalizes the external costs of carbon emissions, thereby increasing enterprises’ carbon emission costs and prompting them to reduce carbon emissions, with the aim of slowing down global warming. Unlike the carbon trading mechanism, the carbon tax mechanism features clear costs. Enterprises can clearly know the tax fees for each unit of carbon emissions, and the price is relatively stable, with strong certainty and predictability, which is conducive to enterprises’ cost accounting and long-term planning. However, it is difficult to adjust the price flexibly according to market supply and demand and emission reduction targets, and it cannot directly control the total amount of emissions, so the certainty of the amount of emission reduction is relatively weak. The specific comparison is shown in Table 1. This table reveals fundamental trade-offs inherent in carbon pricing mechanism design that have significant implications for energy market transformation strategies. The comparative analysis demonstrates that no single mechanism provides optimal outcomes across all evaluation dimensions, necessitating careful consideration of jurisdictional priorities and institutional capabilities.

Table 1. Comprehensive comparison of carbon pricing mechanisms: design principles and market impacts.

|

Mechanism Characteristic |

Carbon Tax System |

Emissions Trading System (ETS) |

Hybrid Approach |

Supporting References |

|---|---|---|---|---|

|

Regulatory Framework |

Direct tax on carbon content or emissions of fossil fuels with government-set rates |

Cap-and-trade system with total emission limits and tradeable allowances |

Combined tax and trading mechanisms with coordinated policy instruments |

|

|

Price Formation Mechanism |

Fixed government-set price providing cost certainty for compliance planning |

Market-determined prices based on supply-demand dynamics with price volatility |

Dual pricing system with tax floor and trading ceiling, creating price corridors |

|

|

Cost Predictability |

High predictability enabling long-term investment planning and cost forecasting |

Lower predictability due to market volatility requires sophisticated risk management |

Moderate predictability with bounded price ranges provides planning certainty |

|

|

Administrative Complexity |

Low complexity with straightforward tax collection and enforcement mechanisms |

High complexity requiring monitoring, reporting, verification, and trading infrastructure |

Moderate complexity balancing administrative burden with policy effectiveness |

|

|

Revenue Generation |

Direct government revenue through tax collection, enabling policy funding |

Revenue depends on the allowance allocation method and trading profits |

Diversified revenue streams through both tax collection and allowance auctions |

|

|

Distributional Effects |

Uniform cost impact across all emitters regardless of abatement cost differences |

Efficient allocation allowing low-cost abaters to reduce emissions for high-cost emitters |

Targeted impact enabling differentiated treatment based on sector characteristics |

The carbon tax system emerges as the most administratively efficient approach with superior cost predictability, making it particularly suitable for developing economies with limited regulatory infrastructure. However, its uniform cost impact creates potentially regressive distributional effects that may undermine political sustainability. The emissions trading system offers superior allocative efficiency through market-based price formation, but requires sophisticated institutional infrastructure that may exceed the capabilities of many jurisdictions.

The hybrid approach presents a compelling compromise that addresses the primary limitations of pure mechanisms while introducing manageable complexity increases. The price corridor framework provided by combining tax floors with trading ceilings offers an innovative solution to the volatility concerns that have plagued standalone ETS implementations while preserving market efficiency benefits.

Most significantly, the distributional effects dimension reveals that mechanism choice has profound implications for industrial competitiveness and just transition considerations. The efficient allocation properties of ETS mechanisms enable targeted support for high-abatement-cost industries while maintaining overall emission reduction effectiveness. This insight suggests hybrid approaches may be essential for managing the political economy challenges of carbon pricing implementation, particularly in jurisdictions with significant industrial exposure to international competition.

In terms of the principle, the carbon tax mechanism in Table 1 follows the “polluter pays” principle, and its core lies in transforming the external costs generated by carbon emissions into the internal production costs of enterprises. Take a thermal power generation enterprise as an example. The imposition of a carbon tax increases the power generation cost. In order to maintain profits and competitiveness, the enterprise will take measures such as improving power generation efficiency or switching to clean energy power generation to reduce carbon emissions and carbon emission costs. The carbon emissions trading mechanism is constructed based on the Coase theorem. After the government sets the cap on the total amount of emissions and allocates the allowances, enterprises can trade the allowances among themselves [7]. Under this mechanism, enterprises with low emission reduction costs can obtain economic benefits by selling the excess allowances, while enterprises with high emission reduction costs need to purchase the allowances, thus promoting the overall emission reduction in the market.

2.3. Strategic Bidding Behaviors under Carbon Pricing Constraints

The two mechanisms also have different impacts on different enterprises. The carbon tax mechanism has a greater impact on small and medium-sized energy-intensive enterprises. These enterprises have limited profit margins, and the increased costs brought about by the carbon tax may become a heavy burden [15]. To cope with the cost pressure, enterprises either have to invest funds in energy conservation and emission reduction technological transformation or face the risk of being eliminated from the market. The carbon emissions trading mechanism provides more flexibility for large enterprises. With their financial and technological advantages, large enterprises are more proactive in emission reduction. They can not only achieve emission reduction by investing in low-carbon technologies and make profits by selling the excess allowances, but also purchase allowances from the market when the allowances are insufficient to maintain the normal production and operation of the enterprises.

The implementation of the carbon pricing mechanism has had quite different impacts on different types of power generation enterprises. For traditional power generation enterprises mainly relying on fossil energy such as coal, carbon pricing is undoubtedly a double-edged sword. On the one hand, carbon pricing significantly increases their power generation costs because traditional power generation enterprises need to pay additional fees for carbon emissions during production. On the other hand, carbon pricing also brings pressure and motivation for transforming and upgrading traditional power generation enterprises. To survive and develop in the fierce market competition, traditional power generation enterprises have to increase their investment in the research, development, and application of energy conservation and emission reduction technologies. They also have to reduce the carbon emission costs through technological innovation to achieve the green and low-carbon transformation. For renewable energy enterprises, carbon pricing is a major development opportunity. Since renewable energy generates almost no carbon emissions during the production process, it has an obvious cost advantage under the carbon pricing mechanism compared with traditional power generation enterprises. This cost advantage makes renewable energy enterprises more competitive in the market competition and enables them to obtain power generation opportunities and market share more easily. With the continuous market share expansion, renewable energy enterprises will have more funds to invest in technological research and development and industrial expansion, further promoting the progress of renewable energy technologies and the growth of the industrial scale.

(1) Carbon Pricing Impact on Fossil-Based Power Generation

The implementation of carbon pricing mechanisms fundamentally alters the operational economics of fossil fuel-based power generation by internalizing previously externalized environmental costs. Research by Liu et al. (2021) demonstrates that thermal power enterprises face critical strategic decisions regarding carbon asset management, with options ranging from technological upgrades to market exit under escalating carbon prices [16]. The cost burden imposed by carbon pricing creates immediate pressure for efficiency improvements and long-term incentives for clean technology adoption, as documented in the comprehensive analysis by Chang et al. (2024) examining green innovation responses among heavily polluting enterprises [17].

(2) Carbon Pricing Effects on Renewable Energy Providers

Renewable energy enterprises experience significant competitive advantages under carbon pricing regimes due to minimal operational emissions. The research conducted by Wang et al. (2024) reveals that government subsidies combined with carbon pricing create powerful synergies that enhance renewable energy auction competitiveness [18]. This dual advantage enables renewable energy providers to expand market share while investing additional resources in technological advancement and capacity expansion, creating positive feedback loops that accelerate clean energy deployment.

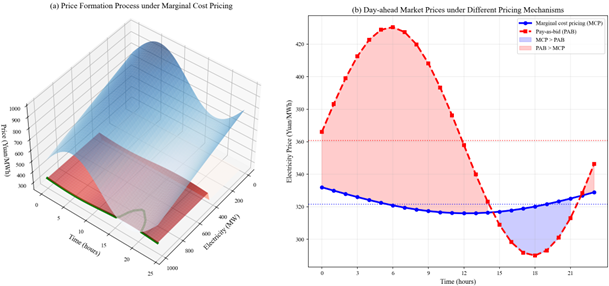

(3) Market Clearing and Pricing Mechanism Analysis

The interaction between carbon pricing and EM clearing mechanisms introduces complex dynamics that influence both short-term operations and long-term strategic planning. Liu et al. (2022) demonstrate that strategic bidding behaviors under marginal cost pricing and pay-as-bid mechanisms exhibit differential sensitivities to carbon price fluctuations [19]. The two-tier bidding model developed by Wang et al. (2024) illustrates how multi-stage carbon incentive mechanisms can optimize market clearing while promoting low-carbon generation [20].

(4) Strategic Bidding Optimization under Carbon Constraints

Power generation enterprises must fundamentally reconsider their bidding strategies when carbon pricing alters traditional cost structures. The evolutionary game framework presented by Cheng et al. (2022) provides insights into long-term strategic adaptation under different market clearing mechanisms [21]. Tang et al. (2021) further demonstrate how market liberalization degrees influence the evolutionary dynamics of generator bidding strategies, revealing critical relationships between regulatory frameworks and strategic behaviors [22].

2.4. Integrated Market Dynamics and Policy Implications

Based on the above, Table 2 provides a comprehensive analysis of the key aspects discussed in this section on carbon pricing mechanisms and EM bidding, focusing on the different ways carbon pricing and bidding mechanisms affect power generation enterprises. Under different pricing and bidding strategies, it systematically evaluates the implications for various stakeholders, including fossil fuel and renewable energy companies.

- Impact on Fossil and Renewable Energy Enterprises: The table clearly highlights the dual role of carbon pricing. For fossil fuel-based power plants, carbon pricing increases operational costs but simultaneously pressures companies to innovate and adopt cleaner technologies. On the other hand, renewable energy companies benefit from a clear cost advantage, enabling them to grow rapidly and increase their market share. This dynamic aligns with the need for balanced policies that promote clean energy development while supporting traditional energy firms’ transitions.

-

Bidding Mechanisms and Market Effects: Both Marginal Cost Pricing (MCP) and Pay-as-Bid (PAB) mechanisms significantly influence energy market operations. MCP ensures price adjustments based on the marginal cost of generation, providing real-time market efficiency. Meanwhile, PAB allows for greater strategic pricing flexibility, encouraging competitive behaviors among power generation enterprises. The policy implications are clear: mechanisms like MCP need refinement to reflect actual market conditions better, while PAB requires balance to avoid monopolistic practices.

-

Technological and Market Adaptation: Both market mechanisms encourage technological innovations—fossil fuel companies must innovate to lower their carbon emission costs, while renewable energy firms expand their capacity through further research and development. This technological progress is crucial to supporting the broader low-carbon transition. The analysis underscores the need for policies that stimulate innovation across both sectors, ensuring competitiveness in the evolving market.

-

Future Research Directions: This table also suggests several key avenues for future research. There is a need to investigate how carbon pricing can be optimized to support energy transitions, integrate EGT with market strategies, and create adaptive policy frameworks that respond to fluctuating energy demands.

In conclusion, Table 2 illustrates the complex, interdependent relationships between carbon pricing, energy market bidding mechanisms, and the strategies adopted by different energy enterprises. These interactions provide valuable insights for policymakers looking to refine carbon pricing mechanisms and optimize bidding strategies to foster a sustainable energy future.

Table 2. Analysis of the impact of carbon pricing mechanisms and EM bidding strategies on energy market dynamics.

|

Aspect |

Description |

Effect on Market Participants |

Implications for Policy |

Technological Implications |

Potential Research Directions |

References |

|---|---|---|---|---|---|---|

|

Impact of Carbon Pricing on Fossil-based Power Generation |

Carbon pricing raises costs for fossil fuel-based power generation, increasing operational expenses due to carbon emission fees. |

Increases costs for fossil fuel power plants, driving technological innovation for emission reduction. |

Suggests the need for policies that mitigate the cost burden on fossil fuel power plants while incentivizing cleaner technologies. |

Fossil fuel firms must invest in cleaner technologies to reduce carbon emissions and remain competitive in the market. |

Further investigation into the effectiveness of carbon pricing mechanisms in fostering a sustainable energy transition for traditional power generation. |

|

|

Effect of Carbon Pricing on Renewable Energy Providers |

Renewable energy firms gain a cost advantage due to minimal carbon emissions, enhancing their market competitiveness under carbon pricing. |

Provides a competitive edge, enabling easier market share acquisition and more funds for technological advancements. |

Highlights the potential for renewable energy to thrive under carbon pricing, necessitating supportive policies for continued growth. |

Renewable energy firms can further reduce costs and expand market share by investing in research and development. |

Exploring how renewable energy firms can use carbon pricing as an opportunity to scale their operations and accelerate technological innovation. |

|

|

Marginal Cost Pricing (MCP) Mechanism |

MCP adjusts electricity prices based on the marginal cost of the last unit of power generation meeting market demand, reflecting real-time cost fluctuations. |

Guides power generation planning, enhancing operational efficiency by adapting to demand changes. |

Indicates the importance of a well-designed MCP framework to reflect market conditions accurately and optimize energy production. |

MCP drives technological improvements to optimize production costs and ensure competitiveness in energy markets. |

Studies on improving MCP mechanisms to ensure they reflect true market costs and optimize energy production across different sectors. |

|

|

Pay-as-Bid (PAB) Mechanism |

PAB allows power generation enterprises to set their own prices, stimulating competition and encouraging cost reduction to maximize economic benefits. |

Encourages competitive behavior, improving efficiency, and reducing costs to gain economic advantage. |

Suggests the importance of balancing PAB mechanisms with market demand to ensure fair competition and prevent monopolies. |

PAB encourages firms to develop efficient bidding strategies by focusing on cost reduction and market analysis. |

Research on balancing the PAB system to maintain fair competition and avoid market manipulation. |

|

|

Bidding Strategy Optimization for Power Generation Enterprises |

Enterprises must optimize production technologies, reduce costs, and assess market conditions to strategically bid and secure market share. |

Firms are encouraged to improve technological efficiency and strategically adapt to market and cost changes to remain competitive. |

Emphasizes the need for policies that promote the technological advancement of power generation enterprises and ensure fair competition. |

Optimizing production technologies and cost structures becomes crucial for companies to remain competitive in a dynamic market. |

Future work can focus on the integration of EGT to model strategic bidding behaviors in evolving markets. |

|

|

Impact of Market Demand on Pricing Mechanisms |

An increase in market demand prompts investment in additional power generation resources, raising the market clearing price; conversely, a decrease reduces prices. |

Market clearing price is dynamically adjusted based on demand, influencing power generation strategies. |

Suggests the importance of flexible policy frameworks that can adapt to demand fluctuations and ensure market stability. |

Fluctuations in demand require adaptive strategies and technological investments to maintain market competitiveness. |

Research on flexible policy structures that allow for real-time market demand adaptation and price adjustment. |

As elaborated above, in the EM, the bidding mechanism is the core mechanism determining the allocation of electricity resources and the formation of prices, mainly including the MCP and PAB mechanisms. The bidding mechanism is crucial for the allocation of electricity resources and the formation of prices. The marginal cost pricing mechanism is one of the more widely applied pricing methods. Under this mechanism, the clearing price of the EM is determined by the marginal power generation cost of the generating unit that finally meets the market demand [25]. For example, in the analysis of the role of marginal cost pricing in the transportation field, Ref. [26] points out that the way it adjusts prices according to cost changes and the resulting impacts are consistent with the pricing mechanism in the EM. When the market demand for electricity increases, the power system must invest in additional generation resources to meet the higher demand. However, as more generation resources are deployed, the last resources added often have a higher marginal cost due to factors such as lower energy efficiency and equipment aging. As a result, the market clearing price rises to balance the costs and revenues. Conversely, when electricity demand decreases, the power system reduces investment in generation resources, and less efficient equipment is taken offline. This leads to a decrease in marginal cost and, consequently, a reduction in the market clearing price. This pricing mechanism effectively reflects real-time changes in marginal power production costs, helping power generation companies optimize their generation schedules based on market demand and cost conditions, thereby enhancing the operational efficiency of the EM.

The PAB mechanism gives power generation enterprises greater autonomy in pricing. Enterprises formulate bidding strategies according to their power generation costs, market expectations, and analysis and judgment of their competitors, and the market clearing price is a comprehensive reflection of the bids of all participating power suppliers [19]. This mechanism fully stimulates the market competition awareness of enterprises, encourages enterprises to improve their bidding competitiveness by reducing costs and improving efficiency, and obtains more power generation shares and economic benefits.

Different bidding mechanisms have a profound impact on the participants in the EM. Under the marginal cost pricing mechanism, power generation enterprises need to continuously optimize their production technologies and reduce the marginal power generation cost to increase their revenues. As pointed out in Ref. [27], in the auction mechanism of the EM, suppliers adjust their bidding strategies to maximize their profits. This is similar to the considerations of power generation enterprises on costs and revenues under the marginal cost pricing mechanism. Power generation enterprises need to continuously optimize their production technologies to reduce costs and enhance their competitiveness in the market, just as suppliers adjust their strategies in the auction mechanism. In the PAB mechanism, power generation enterprises not only need to pay attention to the power generation cost, but also need to analyze aspects such as market supply and demand and the bids of their competitors, to formulate a reasonable bidding strategy and maximize their interests.

There is a close coupling relationship between carbon pricing and EM bidding. The carbon pricing mechanism affects the cost structure of power generation enterprises and thus changes their strategies in the EM bidding. However, this coupling extends beyond simple cost adjustments to encompass complex temporal and cross-market dynamics that fundamentally reshape both carbon and EM operations.

The linkage effects between carbon markets and day-ahead EMs manifest through multiple interconnected channels. First, carbon allowance prices directly influence generation cost structures, propagating through day-ahead market bidding strategies and clearing prices. Second, day-ahead market dispatch decisions determine actual emissions and carbon allowance demand, creating feedback loops that affect carbon market prices. Third, temporal arbitrage opportunities emerge as market participants optimize across both carbon allowance procurement and electricity generation scheduling horizons.

Based on the above, Table 3 provides a comprehensive framework for analyzing these carbon-electricity market linkage effects across multiple dimensions. This comprehensive linkage analysis reveals several critical insights. The cost transmission channel demonstrates that carbon pricing effects are not uniform across time periods, with peak electricity demand periods experiencing amplified carbon price impacts due to the activation of higher-emission generation units. The dispatch optimization dimension shows that carbon markets fundamentally alter EM merit orders, creating systematic shifts in generation patterns that feedback into carbon allowance demand. Investment signals generated through carbon markets create long-term structural changes in EM dynamics, while short-term risk management strategies create complex temporal coupling between the markets.

Table 3. Comprehensive analysis of carbon-electricity market linkage effects.

|

Linkage Dimension |

Carbon Market Impact |

Day-Ahead Electricity Market Impact |

Temporal Coupling |

Policy Implications |

|---|---|---|---|---|

|

Cost Transmission |

Carbon prices increase marginal costs for fossil fuel generators by 15–45% depending on emission factors. |

Higher generation costs lead to increased electricity prices, with peak hour impacts of 20–60% price elevation. |

Real-time carbon price volatility creates hourly cost variations affecting day-ahead bidding strategies. |

Carbon price volatility dampening mechanisms are needed to ensure EM stability. |

|

Dispatch Optimization |

Expected dispatch patterns influence carbon allowance procurement strategies and forward contracting. |

Carbon costs alter merit order dispatch, increasing renewable energy penetration by 10–25% in high carbon price scenarios. |

Day-ahead market clearing determines next-day emissions, affecting intraday carbon allowance trading. |

Coordinated market clearing mechanisms are required to optimize cross-market efficiency. |

|

Investment Signals |

Long-term carbon price expectations drive generation investment decisions toward low-carbon technologies |

Day-ahead market revenue streams influence generation asset valuation and investment timing |

Investment cycles in both markets create multi-year coupling effects on technology deployment. |

Long-term carbon price trajectories must be coordinated with EM design evolution. |

|

Risk Management |

Carbon price hedging strategies affect EM bidding behavior and risk premiums. |

Day-ahead price volatility influences carbon portfolio management and emission allowance holding strategies. |

Cross-market hedging creates temporal dependencies between carbon futures and electricity forward markets. |

Integrated risk management frameworks are needed for market participants operating across both markets. |

|

Market Liquidity |

Electricity sector participation represents 40–60% of carbon market trading volume in major ETS systems. |

Carbon cost uncertainty reduces day-ahead market liquidity and increases bid-ask spreads during volatile periods. |

Intraday trading patterns in carbon markets correlate with day-ahead EM clearing outcomes. |

Market microstructure design should consider cross-market liquidity provision and market making incentives. |

The temporal coupling effects are particularly significant, as they create dynamic interdependencies that cannot be captured through static analysis. Day-ahead EM outcomes directly determine the emission profiles that drive carbon allowance demand, while carbon market price expectations influence EM bidding behavior. This creates a continuous feedback loop that requires sophisticated modeling approaches to capture the system dynamics fully.

Policy implications emerging from this analysis emphasize the need for coordinated market governance structures that recognize these interdependencies. Traditional approaches that treat carbon and EMs independently may create unintended consequences and suboptimal outcomes across both domains. Ref. [20] mentions that carbon pricing will increase the carbon emission costs of thermal power units, and renewable energy units such as wind power and solar energy will be compensated due to their clean energy attributes, affecting the structural transformation of the power generation side. Under the carbon trading mechanism, enterprises with low carbon emission costs have more advantages in bidding. They can participate in the competition in the EM at a more flexible price with their excess carbon emission allowances. The carbon tax mechanism directly increases the costs of power generation enterprises, prompting them to consider costs and revenues more carefully when bidding. At the same time, the bidding results of the EM will also be fed back to the field of carbon pricing. When the EM price changes due to the supply and demand relationship, it will affect the production scale and carbon emission levels of power generation enterprises and thus affect the demand for and price of allowances in the carbon market. This two-way interaction makes carbon pricing and EM bidding form an organic whole, with the day-ahead EM serving as the primary transmission mechanism through which carbon pricing signals propagate to real-time generation decisions and emission outcomes, jointly affecting the development of the electricity industry and the control of carbon emissions.

Since renewable energy power generation enterprises have a cost advantage under the carbon pricing mechanism, their entry will increase the electricity supply in the market, ease the upward pressure on market prices, and also help to reduce the carbon emission levels of the entire EM. This dynamic interaction between carbon pricing and the market clearing price continuously adjusts the supply and demand structure and price system of the EM. It promotes the EM to develop in a sustainable direction.

3. Game Theory and Evolutionary Dynamics in Energy Markets

3.1. Foundations of Game Theory in Bid Design

Game theory provides a mathematical framework for analyzing strategic interactions among rational decision-makers, making it particularly relevant for understanding competitive bidding in EMs. In the context of energy market bid design, game theory addresses fundamental questions about how market participants formulate bidding strategies when their payoffs depend not only on their own actions but also on the strategic choices of competitors.

Classical game theory applications in bid design typically assume complete rationality, perfect information, and static equilibrium conditions. In EMs, generators submit bids representing their willingness to supply electricity at various price levels, while system operators clear the market by selecting the lowest-cost combination of bids to meet demand. The strategic nature of this process creates a game-theoretic environment where each generator’s optimal bidding strategy depends on anticipated competitor behaviors.

Traditional game-theoretic models of EM bidding include Cournot competition, where generators compete on quantity while treating prices as endogenous variables, and Bertrand competition, where participants compete directly on price. Supply function equilibrium models extend these concepts by allowing generators to submit entire supply curves rather than single price-quantity pairs. These approaches have provided valuable insights into market power, price formation, and strategic behavior in deregulated EMs.

However, classical game theory faces significant limitations when applied to carbon-constrained energy markets. The assumption of complete rationality becomes problematic when market participants face unprecedented policy environments with evolving carbon pricing mechanisms. Perfect information assumptions fail to capture the uncertainty surrounding future carbon prices, technological developments, and regulatory changes. Most critically, static equilibrium concepts cannot adequately represent the dynamic nature of energy transition processes, where market participants continuously adapt their strategies based on observed outcomes and changing environmental conditions.

3.2. Carbon Trading Characteristics and the Need for Evolutionary Approaches

Carbon trading mechanisms introduce unique characteristics that fundamentally alter the strategic landscape of EMs, necessitating analytical approaches that can capture dynamic adaptation and learning processes. These characteristics create compelling justifications for EGT as the appropriate modeling framework.

First, carbon pricing mechanisms generate unprecedented uncertainty in cost structures and competitive positions. Unlike traditional fuel price volatility, carbon prices reflect complex interactions between environmental policy, technological innovation, and market speculation. This uncertainty prevents market participants from forming precise expectations about competitor strategies, violating the perfect information assumptions underlying classical game theory. EGT addresses this limitation by modeling strategy evolution under bounded rationality, where participants adapt based on observed performance rather than complete market knowledge.

Second, the energy transition represents a fundamental shift in technological and economic paradigms, creating conditions where historical experience provides limited guidance for future strategic decisions. Market participants must experiment with new technologies, business models, and bidding strategies while learning from both their own experiences and competitor behaviors. This learning process aligns naturally with EGT’s emphasis on strategy adaptation through imitation of successful behaviors and mutation of existing strategies.

Third, carbon trading markets exhibit strong path-dependence effects, where early strategic choices significantly influence long-term competitive positions and market structures. The irreversible nature of infrastructure investments in renewable energy technologies or carbon capture systems creates strategic complementarities that evolve over time. EGT captures these dynamics through replicator dynamics that track the changing frequency of different strategies in the population.

Fourth, policy interventions in carbon markets often trigger cascading effects that propagate through the market over extended time periods. Subsidy programs, penalty mechanisms, and regulatory changes create shifting competitive landscapes that require continuous strategic adaptation. Traditional static equilibrium concepts cannot capture these adjustment processes, while EGT provides tools for analyzing convergence to new equilibria following policy shocks.

3.3. EGT: Mathematical Framework and Core Concepts

Evolutionary game theory (EGT) extends classical game theory by incorporating dynamic strategy evolution based on differential success rates rather than perfect rationality assumptions. The mathematical foundation rests on the replicator dynamic equation, which describes how the frequency of different strategies changes over time based on their relative performance.

Consider a population of energy market participants choosing from a set of strategies S = {s1, s2, ..., sₙ}. Let xᵢ(t) represent the proportion of the population using strategy sᵢ at time t, where Σᵢ xᵢ(t) = 1. The fitness of strategy sᵢ is given by f(sᵢ, x(t)), representing the expected payoff when the population state is x(t). The average fitness of the population is φ(x(t)) = Σᵢxᵢ(t)·f(sᵢ, x(t)). Thus, the replicator dynamic equation governs strategy evolution: ẋᵢ = xᵢ·[f(sᵢ, x(t)) − φ(x(t))].

This equation indicates that strategies with above-average fitness increase frequency, while below-average strategies decline. The equilibrium concept in EGT is the evolutionarily stable strategy (ESS), which represents a strategy distribution that cannot be invaded by small populations using alternative strategies.

For carbon-constrained energy markets, the fitness function f(sᵢ, x(t)) incorporates traditional economic payoffs and carbon-related costs and benefits. This creates complex fitness landscapes where renewable energy strategies may have lower immediate payoffs but superior long-term evolutionary stability under rising carbon prices.

3.4. EGT Applications in Power Markets

The EGT integrates traditional game theory with biological evolution theory and analyzes the long-term change trends of individual strategies in a group from the perspective of dynamic evolution. Different from traditional game theory, it assumes that participants are not completely rational but adjust their own behaviors by continuously learning from and imitating the strategies of others. The replicator dynamic equation is its core tool, which is used to describe the dynamic process of the proportion of individuals with different strategies in a population changing with the payoff. In this process, the proportion of high-payoff strategies in the group gradually increases, while low-payoff strategies tend to be eliminated. The ESS reveals the long-term stability of group behavior. When the vast majority of individuals adopt this strategy, it is difficult for small-scale mutant strategies to invade and replace it [28]. The EGT is suitable for analyzing scenarios with multiple agents, bounded rationality, and dynamic evolution. Its advantage lies in being able to better describe the behavior patterns of real individuals and revealing the long-term trends of group behavior through dynamic analysis. The theoretical model is based on assumptions such as individual strategy selection relying on payoff comparison, and the randomness and gradualness of strategy adjustment. Core parameters such as the strategy payoff matrix, the strategy adjustment rate, and the group size jointly determine the evolutionary path and stable state of the system.

The application of EGT to power markets has revealed fundamental insights into long-term market evolution under technological and regulatory change. Unlike static game-theoretic models that focus on immediate equilibrium outcomes, evolutionary approaches illuminate the pathways through which markets transition between different competitive structures.

In the EM, the EGT provides a new perspective and method for analyzing complex systems with multiple agents and multiple strategies. The agents in the EM include traditional power generation enterprises, renewable energy enterprises, grid operators, consumers, etc. Among them, the game between traditional power generation enterprises and renewable energy enterprises is an important driving force for market evolution. There are differences in cost structures and technical characteristics between these two types of enterprises, and the EGT can be used to analyze their strategic choices in different policy environments and the impacts on the market structure. In addition, the agents in the EM face a variety of strategic choices, such as bidding strategies, carbon emission reduction strategies, and green certificate trading strategies.

Early applications in power markets focused on generation technology choice, where utilities must decide between investments in conventional fossil fuel plants versus renewable energy technologies. Evolutionary models demonstrate how carbon pricing mechanisms can trigger tipping points where renewable strategies become evolutionarily dominant, even when they initially have higher costs. These transitions exhibit hysteresis effects, where the path to renewable dominance depends on the speed and magnitude of carbon price increases.

The EGT can analyze the long-term evolutionary trends of these strategies and their impacts on market efficiency and environmental benefits. For example, for complex systems with multi-agent interactions, Ref. [29] constructs a dynamic evolutionary game model covering multiple agents, providing a theoretical basis for various stakeholders to explore optimal strategies. Regarding the interest coordination between renewable energy and traditional energy enterprises, Ref. [30] takes into account the green certificate price and carbon emission reduction costs and proposes reliable strategies. Besides, Ref. [31] analyzes the strategic behaviors of carbon trading enterprises through an evolutionary game.

Market structure evolution represents another significant application area. EGT explains how deregulated EMs evolve from concentrated oligopolies dominated by large thermal generators toward more fragmented structures with numerous renewable energy producers. This structural evolution emerges naturally from differential growth rates between technology types rather than regulatory mandates.

Strategic bidding behavior in evolutionary contexts differs fundamentally from static optimization approaches. Market participants develop bidding heuristics through trial-and-error learning processes, gradually converging toward strategies that perform well against the evolving population of competitor strategies. This creates complex co-evolutionary dynamics where optimal bidding strategies continuously evolve in response to changing competitor behaviors and market conditions.

Moreover, the EM dynamics requires the modeling method to adapt to complex environmental changes. The EGT can better describe the strategic adjustment process of market agents by introducing dynamic equations and stochastic processes. By combining the replicator dynamic equation with the stochastic differential equation, it is possible to analyze the impacts of policy changes, technological progress, and market demand fluctuations on the behaviors of market agents. In this regard, Ref. [32] constructs a stochastic evolutionary game model and uses numerical simulation and the three-party replicator dynamic equation to analyze the impacts of the Trading of Green Certificates (TGC) on the decision-making behaviors of the three parties, providing valuable insights for policy-making. Ref. [33] predicts the payoffs and strategic choices of enterprises by calculating their replicator dynamic equations. Ref. [21] designs an evolutionary game analysis program to describe the properties of local dynamics in the dynamic process of the system, helping the groups participating in bidding to correct and improve their behaviors continuously. Table 4 summarizes the applications of EGT in EMs.

Recent research has extended EGT to multi-market interactions, where participants simultaneously compete in EMs, capacity markets, and carbon trading systems. These applications reveal how policy design in one market can generate unintended consequences in related markets through evolutionary spillover effects.

Table 4. Systematic analysis of key literature in EGT and energy market applications.

|

Reference |

Research Focus |

Methodological Approach |

Carbon Pricing Integration |

Key Findings and Limitations |

|---|---|---|---|---|

|

Narassimhan et al. (2018) [10] |

Emissions trading systems review |

Comparative policy analysis |

Comprehensive ETS examination across regions |

Thorough policy evaluation; lacks strategic interaction modeling |

|

Wang et al. (2024) [20] |

Multi-stage carbon joint incentive clearing |

Two-tier bidding model |

Coupled electricity-carbon market integration |

Advanced market coupling approach; limited evolutionary dynamics |

|

Wettergren (2023) [28] |

Replicator dynamics of evolutionary games |

Mathematical analysis of cost-benefit delays |

General framework without energy focus |

Establishes a theoretical foundation; lacks energy market application |

|

Fan et al. (2024) [29] |

Carbon trading market equilibrium |

Tripartite evolutionary game perspective |

Central focus on carbon market dynamics |

Demonstrates game theory effectiveness; limited bidding strategy analysis |

|

Wu et al. (2023) [30] |

Supply chain coordination under a renewable quota |

Stackelberg game comparing decision types |

Renewable energy quota system integration |

Effective supply chain optimization; insufficient market-wide analysis |

|

Wu et al. (2024) [31] |

Enterprise energy behaviors in carbon trading |

Benefit-cost evolutionary game framework |

Direct carbon trading impact assessment |

Reveals trading behavior patterns; limited policy optimization insights |

|

Teng et al. (2025) [32] |

Trading strategies under renewable portfolio standards |

Stochastic evolutionary game with noise simulation |

Renewable energy certificate market focus |

Advanced stochastic modeling; narrow scope on specific trading mechanisms |

|

He et al. (2023) [33] |

Chinese Certified Emission Reduction promotion |

Tripartite evolutionary game model |

CCER program and carbon market integration |

Comprehensive policy analysis; limited international applicability |

|

Cheng et al. (2022) [21] |

Strategic long-term bidding in deregulated markets |

Two-population n-strategy evolutionary game |

Multiple market clearing mechanisms |

Innovative bidding strategy framework; minimal carbon pricing consideration |

|

Reka et al. (2024) [34] |

Machine learning in demand response |

Big data analytics and AI applications |

Privacy and security considerations |

Technological advancement focus; insufficient game-theoretic integration |

As summarized in Table 4, the systematic examination of existing literature reveals several critical insights regarding the current state of EGT applications in energy markets under carbon constraints. The theoretical foundations established by [28] provide essential mathematical frameworks for understanding replicator dynamics, yet these general approaches require substantial adaptation for energy market contexts. The carbon trading applications demonstrated by [29,31] successfully illustrate the effectiveness of evolutionary game approaches in capturing market dynamics, but their analyses remain concentrated on specific market segments without comprehensive integration of bidding strategies and policy optimization.

The stochastic modeling innovations introduced by [32] represent significant methodological advances that address uncertainty in renewable energy markets, while the policy-focused analyses by [33] demonstrate the practical applicability of evolutionary approaches for regulatory design. However, these studies exhibit limited scope regarding comprehensive market-wide analysis and international policy transferability. The strategic bidding framework developed by [21] provides valuable insights into long-term market evolution, yet lacks sufficient integration with carbon pricing mechanisms that fundamentally alter competitive dynamics.

The comparative policy analysis by [10] offers a comprehensive understanding of emissions trading systems but fails to incorporate strategic interaction modeling that captures behavioral adaptation processes. The advanced market coupling approach presented by [20] demonstrates sophisticated integration of electricity and carbon markets, yet overlooks evolutionary dynamics that govern long-term strategic adaptation. Finally, the technological perspectives provided by [34] highlight emerging opportunities for integrating machine learning with energy market analysis, but insufficient attention to game-theoretic foundations limits their applicability for strategic behavior modeling.

This literature synthesis reveals fundamental gaps in comprehensive frameworks that simultaneously address evolutionary strategic dynamics, carbon pricing mechanisms, and policy optimization, thereby establishing the necessity for our integrated review approach.

In addition, simulation methods based on intelligent algorithms, such as genetic algorithms and particle swarm optimization, are also widely applied to the solution and analysis of evolutionary game models. Future research can integrate multi-agent modeling and real-time data-driven technologies to construct a digital twin system that is closer to the real market ecology, promoting the game theory in the EM to leap from explaining phenomena to predicting decisions.

3.5. Evolutionary Dynamics under Carbon Pricing Mechanisms

Carbon pricing mechanisms fundamentally alter the evolutionary dynamics of power markets by introducing new selection pressures that favor low-carbon strategies. The strength and stability of these selection pressures depend critically on carbon price levels, volatility, and credibility of long-term policy commitments.

Under low carbon prices, evolutionary dynamics may converge to mixed equilibria where fossil fuel and renewable strategies coexist in stable proportions. The stability of these mixed equilibria depends on the precise balance between carbon costs and technology cost differentials. Small changes in carbon prices can trigger dramatic shifts in equilibrium strategy distributions, demonstrating the importance of policy design for market evolution outcomes.

High carbon prices create strong selection pressures favoring renewable energy strategies, potentially leading to rapid evolutionary convergence toward low-carbon equilibria. However, the transition speed depends on factors such as capital stock turnover rates, learning curve effects, and infrastructure complementarities. EGT provides tools for analyzing these transition dynamics and predicting convergence timeframes under different policy scenarios.

Carbon price volatility introduces additional complexity by creating time-varying fitness landscapes where optimal strategies change continuously. This volatility can prevent convergence to stable equilibria, instead generating persistent evolutionary cycles or chaotic dynamics. Market participants must balance exploiting current profitable strategies against exploring alternatives that may become advantageous under different carbon price regimes.

Policy credibility emerges as a crucial factor determining evolutionary outcomes. When market participants doubt the long-term sustainability of carbon pricing policies, they may maintain fossil fuel strategies despite temporarily adverse fitness differentials. EGT captures these effects through discounted fitness functions that weight near-term payoffs more heavily than uncertain future benefits.

As summarized in Table 5, this comparative analysis reveals why EGT emerges as the superior theoretical framework for modeling carbon-constrained energy markets. The table systematically evaluates five major game-theoretic approaches across critical dimensions that determine their applicability to carbon trading environments.

Table 5. Comparative analysis of game theory approaches in carbon-constrained energy markets.

|

Theoretical Framework |

Information Requirements |

Rationality Assumptions |

Temporal Scope |

Carbon Market Suitability |

Policy Adaptation Capability |

|---|---|---|---|---|---|

|

Classical Game Theory |

Perfect/complete information |

Full rationality |

Static equilibrium |

Limited—fails under price volatility |

Poor—requires resolving for policy changes |

|

Bayesian Game Theory |

Incomplete but known distributions |

Rational Bayesian updating |

Static with uncertainty |

Moderate—handles some uncertainty |

Moderate—requires new prior distributions |

|

Repeated Game Theory |

Perfect recall of history |

Perfect rationality with reputation |

Multi-period static |

Moderate—captures some dynamics |

Limited—strategy sets remain fixed |

|

EGT |

Bounded/local information |

Bounded rationality with learning |

Dynamic evolution |

High—naturally handles volatility |

Excellent—continuous adaptation to policy changes |

|

Mean Field Games |

Statistical information only |

Rational representative agent |

Dynamic equilibrium |

Moderate—limited heterogeneity |

Good—can incorporate policy parameters |

Despite its mathematical elegance, classical game theory demonstrates fundamental inadequacies for carbon market analysis. The perfect information requirement becomes unrealistic given the unprecedented uncertainty surrounding carbon price evolution, technological breakthroughs, and policy sustainability. The static equilibrium focus cannot capture the dynamic transition processes that characterize energy market transformation under carbon constraints.

Bayesian game theory offers marginal improvements by accommodating uncertainty through probability distributions, yet it retains the rational optimization framework that proves problematic when market participants face novel strategic environments without historical precedents. The requirement for known probability distributions becomes particularly problematic in carbon markets, where structural breaks and policy innovations create non-stationary environments.

Repeated game theory captures some temporal dynamics through reputation mechanisms and trigger strategies, but maintains fixed strategy sets that cannot evolve with changing technological and regulatory landscapes. This limitation proves critical in carbon markets where innovation continuously expands the available strategic options.

EGT demonstrates clear superiority across all evaluation criteria. Its bounded rationality assumptions align with observed behavior in uncertain environments, while the dynamic evolution framework naturally accommodates the continuous adaptation required in carbon-constrained markets. The framework’s ability to handle volatile carbon prices and adapt to policy changes makes it uniquely suited for energy transition analysis.

Mean field games offer sophisticated mathematical tools for large-population interactions but assume rational representative agents that may not capture the heterogeneous learning processes observed in real energy markets. While useful for certain analytical purposes, they lack the behavioral realism of evolutionary approaches.

This analysis strongly supports the adoption of EGT as the primary analytical framework for understanding strategic behavior in carbon-constrained energy markets.

4. Evolutionary Game Modeling Framework for Strategic Bidding under Carbon Pricing Constraints

4.1. Evolutionary Game Modeling of Strategic Bidding

4.1.1. Bidding Strategy Formulation in Evolutionary Framework

Strategic bidding in carbon-constrained EMs involves generators submitting price-quantity pairs that reflect both immediate profit maximization and long-term evolutionary adaptation. We model this process through an evolutionary game where generators employ different bidding heuristics that evolve based on their relative success over time. Thus, we consider a population of generators N = {1, 2, ..., n} where each generator i can adopt one of four distinct bidding strategies: S = {S1, S2, S3, S4}. Strategy S1 represents marginal cost bidding where generators bid their true production cost, including carbon expenses. Strategy S2 involves strategic markup bidding where generators add a percentage markup above marginal cost to capture market power. Strategy S3 denotes carbon-adjusted bidding where generators incorporate expected future carbon price trends into current bids. Strategy S4 represents environmental premium bidding where low-carbon generators bid slightly above marginal cost to capture green value.

Let xj(t) represent the fraction of generators using strategy Sj at time t, where Σj xj(t) = 1. The bidding function for a generator using strategy Sj is defined as:

| $$ {b}_{j}\left(M{C}_{i},{C}_{t},x\left(t\right)\right)={\alpha }_{j}\cdot M{C}_{i}+{\beta }_{j}\cdot {C}_{t}\cdot {E}_{i}+{\gamma }_{j}\cdot \mu \left(x\left(t\right)\right) $$ |

(1) |

where MCi is generator i’s marginal cost, Ct represents the current carbon price, Ei denotes emission intensity, and μ(x(t)) captures strategic interactions based on the population strategy distribution. The parameters αj, βj, γj are strategy-specific coefficients that determine bidding behavior.

4.1.2. Market Clearing and Dispatch Mechanism

The EM operates through a uniform price auction where generators submit bids and the system operator selects the lowest-cost combination to meet demand. Under carbon pricing, the merit order ranking depends on both generation costs and carbon expenses, creating complex interdependencies between bidding strategies and dispatch outcomes.

The market clearing price P(t) emerges from the intersection of aggregate supply and demand: