Found 3 results

Open Access

Article

03 September 2025From Fossil to Future: Trade, Technology and Clean Energy Transitions in High-Impact Developing Economies

This study examines the impact of economic growth, renewable energy equipment imports, and energy use on CO2 emissions in seven developing countries over the period 2000–2021, employing second-generation panel estimators (Augmented Mean Group AMG, The Common Correlated Effects Mean Group CCEMG) that account for cross-sectional dependence and slope heterogeneity. Results show that economic growth and energy use significantly increase emissions, while renewable energy equipment imports display no direct or robust mitigating effect. This limited impact likely reflects adoption and integration challenges and the absence of complementary policies, underscoring the need for strategies that link imports to technology transfer and domestic manufacturing capacity. Granger causality tests indicate that growth and renewable energy imports drive emissions, highlighting the necessity for integrated green industrial policies, carbon pricing mechanisms, and sustainable finance instruments. These findings suggest that, for developing economies, achieving low-carbon growth requires a coordinated policy mix that aligns environmental objectives with economic development goals.

Open Access

Article

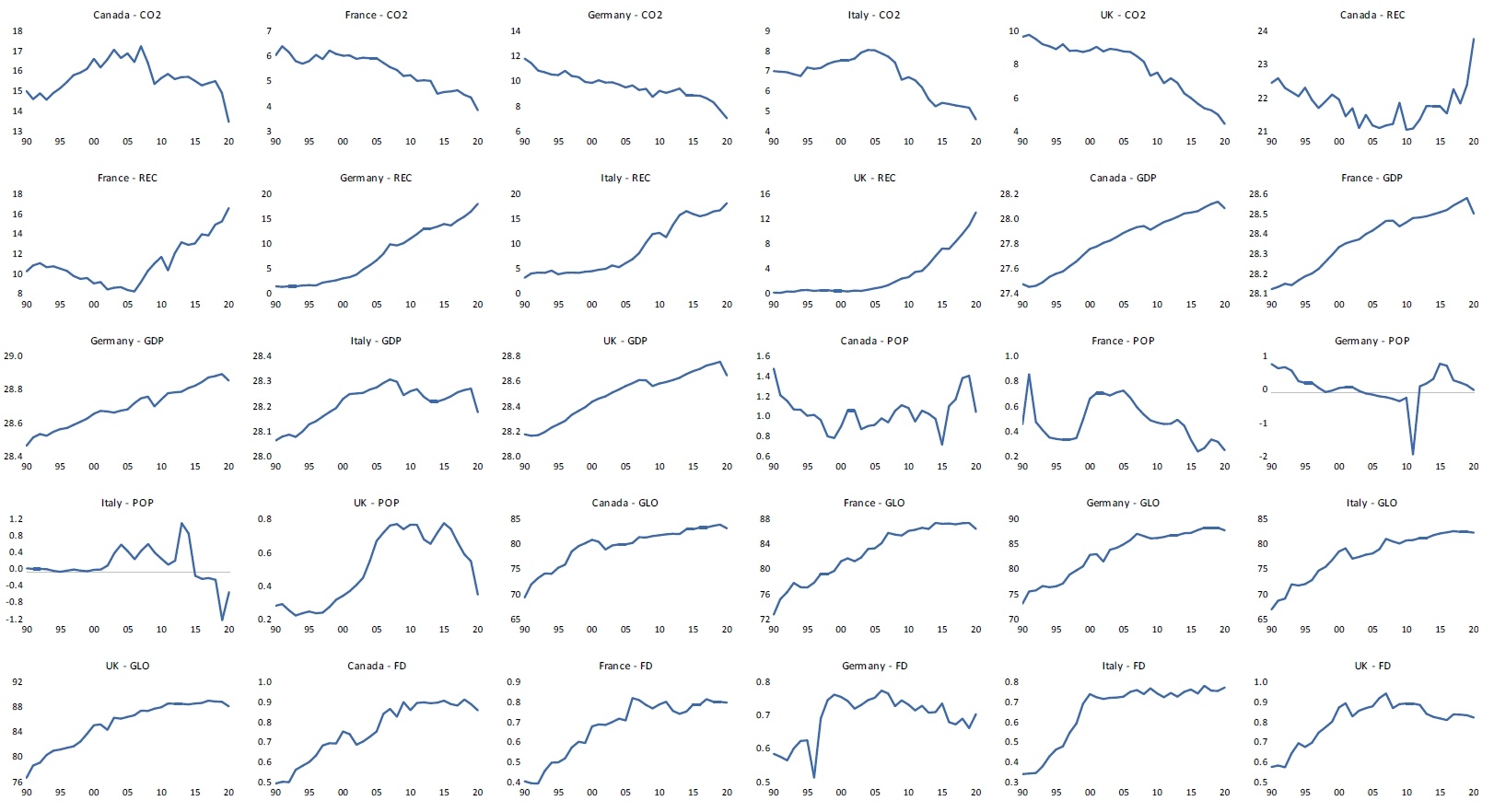

21 November 2024The Impact of Renewable Energy Consumption, Economic Growth, Globalization, and Financial Development on Carbon Dioxide Emissions: Evidence from Selected G7 Economies

The aggregate upsurge in carbon dioxide emissions (CO2) witnessed through environmental degradation and global climate change is a call for great concern. This, therefore, calls for the enactment, utilization and implementation of provisions and policies geared towards curbing this global economic bad without impeding global economic growth rates. This study ascertains the extent to which renewable energy consumption (REC), economic growth (GDP), population growth (POP), globalization (GLO), and financial development (FD) affect carbon dioxide emissions (CO2) in selected G7 economies (France, Germany, Canada, Italy, and the United Kingdom) from 1990–2020. The Dynamic Fixed Effect Autoregressive Distributive Lag (DFE-ARDL) and the Pooled Mean Group ARDL (PMG-ARDL) methods were employed for analysis. The empirical findings for DFE-ARDL showed that REC, GDP, and POP have an adverse association with CO2 in the long-term. However, in the short-term, REC and FD improve the environment, while GDP and POP drive CO2. It is observed that the result for REC in the short and long-run is consistent. The PMG-ARDL results revealed that REC and GLO negatively affect CO2 in the long-run, and in the short-run, GDP spurs CO2, while FD reduces it. The result summary of both methods employed demonstrates that REC, GLO, and FD benefit the environment. At the same time, GDP and POP harm the environment in the short-run but reduce CO2 in the long-run. Conclusively, the research recommends increasing the utilization of renewable energy and policies that enable economic growth and CO2 to move in the opposite direction.

Open Access

Article

01 November 2024Energy Consumption and Economic Growth: Evidence from Electricity and Petroleum in Eastern Africa Region

This study investigates the distinct impacts of electricity and petroleum consumption on economic growth in Eastern Africa. Using a Panel Autoregressive Distributed Lag Model and data for a period spanning 2000 to 2021, the study examines both the short-run and long-run effects of these energy sources on Gross Domestic Product. The findings reveal that petroleum consumption has a statistically significant and positive impact on GDP in both the short run and long run. In contrast, while electricity consumption shows a positive but statistically insignificant effect on GDP in the short run, it exhibits a negative and statistically significant impact in the long run. These results suggest that policymakers in Eastern Africa should prioritize sustainable petroleum management to maximize its economic benefits while mitigating potential environmental risks. While the negative coefficient of electricity implies a corrective response of the variables to long-run equilibrium in the face of short-term shocks. As a result, it is recommended that economic shocks caused by energy consumption be considered in terms of their relationship to economic growth, whether positive or negative in the long or short term, as decision makers need to address their impact and limit such shocks on economic growth.