1. Introduction

Energy consumption is an essential requirement for human existence and plays an important role in driving economic growth worldwide [

1]. The importance of energy lies not only in its ability to fuel productive activities but also in its facilitation of household consumption. Undoubtedly, the efficient utilization of energy is widely acknowledged as a fundamental element in the pursuit of inclusive and tool for economic growth worldwide [

2,

3]. This relationship between energy consumption and economic growth, however, is influenced by various factors such as consumption patterns, and policy interventions [

4,

5]. These complexities make energy a key driver of growth, yet the link remains unpredictable in both developed and developing countries, as also indicated by [

6,

7]. Consequently, the region-specific empirical evidence is crucial to inform energy policy actions tailored to local conditions, especially in the context of Eastern Africa regions.

According to Energy Agency Outlook [

6], global energy demand has seen a consistent increase in recent decades, largely driven by non-OECD countries, such as the sub-Saharan Africa nations. However, despite Africa’s rising energy demands, the region’s electricity and petroleum consumption levels remain significantly lower compared to global standards. In 2018, Africa accounted for only about 700 terawatt-hours, or approximately 4% of global electricity consumption, with other regions like Asia and North America constituting significantly larger shares of 42% and 20%, respectively [

7]. In a similar vein, Africa’s petroleum consumption stood at approximately 2.7 million barrels per day in 2018, which is about 3% of the global total, significantly trailing consumption levels in other regions [

8]. Given these figures, it is clear that energy consumption in Africa, such as electricity and petroleum, remains significantly lower than international benchmarks, and understanding their impact on economic growth is critical for informing investment decisions and targeted policy measures aimed at increasing regional energy consumption.

The Eastern Africa regions, with its expanding economy, is experiencing increasing energy consumption needs. While studies such as in ref. [

9] have examined the effects of renewable energy and environmental sustainability on economic growth in Africa [

9]. The several papers contrasted the effects of renewable and nonrenewable energy sources on economic growth across diverse African regions taking into account on enviromental degradation, e.g., [

10,

11]. They did not specifically address the relationship between energy consumption and economic growth in these regions. Energy consumption in terms of availability are critical for supporting key economic activities, particularly in industries such as manufacturing, transportation, and services. However, the region continues to face challenges such as insufficient energy supply, such as unreliable electricity, and the volatility of petroleum prices, particularly for manufacturing and transportation sectors that heavily depend on these energy sources [

12]. These challenges are also driven by the need to modernize the economy, rapid population growth, urbanization, and industrialization, all of which intensifies the need to explore the impact of electricity and petroleum consumption on economic growth in Eastern Africa. Thus, this research aims to investigate the short- and long-run impacts of electricity and petroleum consumption on economic growth in Eastern Africa regions, providing a comprehensive analysis that informs energy policy actions tailored to the region’s unique conditions.

Additionally, in an attempt to overcome these hurdles, Eastern African governments have proactively invested in initiatives designed to address these energy challenges, exemplified by projects like the East African Power Pool, which aims to enhance infrastructural capacity and improve access to reliable electricity [

13,

14]. Furthermore, regional integration is being pursued to increase the electricity supply and distribution networks [

12]. Notwithstanding the potential benefits, reliance on imported petroleum poses economic growth vulnerabilities, underlining the need for a balanced energy strategy [

15,

16,

17,

18]. These axpects highlight the region’s need for research that can guide policy actions to address the dual situation between energy consumption and economic growth. We are aware that these regions face similar challenges, such as low energy consumption levels, reliance on imported petroleum, and a lack of reliable electricity supply, as reported in current studies [

12]. Most existing empirical studies on the effects of energy on economic growth focus on global or national contexts, overlooking the regional impacts of energy, particularly electricity and petroleum (Eastern Africa regions). According to IRENA, I.R.E.A. (2020), the share of electricity generation in the regions from various sources rises from 116,683 GWh (2.78%) of the global total in 2010 to approximately 160,236 GWh, but falls in percentage terms to only 2.48% of the global total in 2018 [

19]

Some research shows that East African subregions achieve the highest economic growth rates [

20,

21] compared to other regions but have the lowest energy consumption. It contradicts findings from Kober et al. and Chen et al. [

22,

23], which suggest that high economic growth leads to higher energy consumption, particularly in energy-intensive sectors like industries. With the lowest energy consumption in the regions of Eastern Africa, we are aware of several energy project interventions and strategies, including the Stiegler Gorges Dam project in Tanzania, the Uganda-Tanzania crude oil pipeline, and the Tanzania-Kenya gas pipeline, which aim to increase energy consumption and stimulate economic growth. The above energy strategies have not been tested to determine whether there is a short- or long-run causal relationship between energy consumption and economic growth, establishing that high energy consumption causes high economic growth.

Accodingly, this study close these gaps by analysing the short- and long-run impacts of electricity and petroleum consumption on economic growth in Eastern Africa. By focusing on these specific energy sources, the research provides a nuanced exploration that contributes to a better understanding of the region’s energy dynamics. It also considers macroeconomic variables such as labour force, physical capital, and price volatility to fully capture the complexities of energy consumption impacts of econmic growth in Eastern Africa regions. This research contributes to the existing literature in three ways. First, by focusing on Eastern African regions, it offers fresh insights into the energy-growth nexus, specifically in the context of electricity and petroleum consumption, which are under-researched yet critical for the region’s development. Second, it explores both short- and long-run impacts of energy consumption, revealing the underlying mechanisms that drive economic growth. Finally, the study provides practical guidance for policymakers, offering evidence-based recommendations to enhance energy access and promote sustainable economic development in Eastern Africa. The rest of the study is structured into four main parts: Literature Review, Methodology, results and discussion and Conclusion with Policy Recommendations.

2. Literature Review

2.1. Theoretical Framework

This study employs a neo-classical growth model that recognizes energy as a crucial input driving economic growth in the modern world [

15,

16,

24]. In contrast to traditional growth theories, such as the Harrod-Domar and Solow-Swan models as stated by Orlando et al. and Chetty and Pradhan [

17,

18], which focus solely on capital and labour as key production factors, our model acknowledges the significant role of energy in economic growth. Crucially, we also incorporate a price index as a key variable, recognizing that prices directly impact production decisions by influencing the cost of inputs [

25,

26]. Energy prices, in particular, signal scarcity or abundance in the market, influencing resource allocation and the adoption of energy-efficient technologies [

27,

28]. Specifically, we examine the neo-classical growth model with the focus on electricity and petroleum consumption to understand their influence on economic growth in Eastern African, which are experiencing rapid change and rising energy demands, reported driven in part by population growth. Dynamics prices of these energy influence consumption patterns, investment choices, and overall economic activity; therefore, by including its prices, we account for these effects and capture the influence of price volatility on the relationship between energy and economic growth. Therefore, our augmented growth model provides insights into the roles of both modern inputs (energy consumption and price) and traditional inputs (capital and labour) in driving economic growth in Eastern Africa. This approach emphasizes energy resources as crucial for productivity, illuminating the interplay between energy markets and economic growth while acknowledging the continued importance of traditional inputs.

2.2. Empirical Studies

Empirical studies has extensively examined the relationship between energy utilization and economic growth, employing different methods in diverse regions [

11,

28,

29,

30,

31]. For example, ref. [

31], examined how growth, industrialization, and urbanization influence energy use and emissions in both developing and developed countries, aiming to guide sustainable energy policy. The results indicate that the impact of energy on economic growth varies by source and location. Similarly, ref. [

27] used Panel Vector Autoregression (PVAR) analysis across 124 countries from 1980 to 2018 and found that energy’s effect on GDP differs by a country’s income level, being positively significant in higher and lower-income nations, but not middle-income ones. Recent studies, such as in ref. [

31], have further explored the causal relationship between energy consumption and economic growth, demonstrating complex interactions that vary depending on regional and economic contexts. Ref. [

32], also emphasized the role of energy efficiency in mitigating environmental impacts while maintaining economic growth. These studies provide additional insights into the multifaceted nature of energy consumption, particularly in developing regions.

In G7 countries, ref. [

33] conducted a comprehensive study examining the intricate relationship between renewable and non-renewable energy consumption and economic growth. Utilizing advanced panel data analysis techniques, the research spanned Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States to uncover the long-run and short-run effects of various forms of energy consumption in molding economic growth. The findings confirm complex interactions between energy sources and economic performance in these developed economies. Similarly, a study conducted by Topcu et al. [

34] shows one way causality relationship from energy consumption (oil, natural gas and coal) to economic growth in Germany, Italy, Japan, U.S, Italy, Japan, U.S, U.K, Canada. Whereas, from economic growth to energy consumption evidenced in others. Ref. [

35] conducted an analysis to unravel the relationships between transportation, economic growth, and environmental degradation in Asian economies. The study used the panel autoregressive distributive lag (Panel-ARDL) method to assess both long-run and short-run effects. This research highlighted transportation as a major factor influencing both economic progression and environmental health, in addition to GDP and urbanization. These findings illuminate the interplay between these elements within Asian countries with the use of Panel ARDL. Whereas, in the African context, ref. [

36] focused their analysis on African OPEC nations, using the ARDL method to explore the changing aspects of energy consumption and economic growth. Their research highlighted the unique impact of energy consumption on economic development within this subset of countries, providing tailored insights into their energy-growth nexus.

Further, ref. [

37] study covered Africa to explore how electricity consumption affects economic growth, employing System Generalized Method of Moments techniques. They found a positive correlation between electricity use and economic growth, underscoring electricity’s essential role in the continent’s economic development. Ref. [

38], focused on Botswana, analyzing data from 1980 to 2016 using the ARDL-bound testing approach. The findings suggest Botswana’s economy is not heavily dependent on energy, which could allow for energy conservation measures without hindering economic growth. Similarly, ref. [

37] examined the varying impacts of petroleum and natural gas consumption on the economies of different African countries with the Non-linear Autoregressive Distributed Lag model. The study illuminated diverse patterns in the energy-growth relationship, highlighting the unique energy dynamics within Africa. Furthermore, ref. [

39] expanded on these studies by examining the non-linear connection between energy consumption and economic expansion in selected African nations from 1971 to 2014. By applying a non-linear panel autoregressive distributed lag model, they identified variations in the impact of energy use on economic growth across various phases of the economic cycle.

Concurrently, ref. [

40] explored the interactions among fossil energy consumption, economic growth, oil prices, and carbon emissions in 22 African nations, providing a holistic view of the multifaceted relationships and policy implications that characterize energy use and economic development in the region. Similarly, ref. [

41] investigated the influence of renewable energy consumption on economic development in 24 MENA countries beginning 1980 to 2015, finding that renewable energy has a minimal effect on their economies. Ref. [

5] with 12 MENA countries linked renewable energy use, economic growth, foreign investment, trade, and carbon emissions, stressing the importance of transitioning to renewables for sustainable growth. The effects of energy on economic growth are found to vary by country, which has implications for policy-making, as demonstrated in the ref. [

27,

41,

42,

43] collectively, provides insights of the energy-growth nexus in Africa, offering the consequences of energy use on economic progress in this continent. Additionally, ref. [

44] explored the non-linear nexus between energy consumption and total factor productivity, underscoring the importance of energy efficiency in promoting sustainable economic growth.

In East Africa, ref. [

45] analyzed the relationship between infrastructure development and economic growth, offering policy guidance for enhancing infrastructure’s economic impact. Whereas, ref. [

46] applied time-varying causality methods to analyze total factor productivity, energy consumption, and CO

2 emissions in the G20 nations, providing a comparative analysis relevant to understanding energy dynamics in Eastern Africa. Similarly, ref. [

47] investigated the link between CO

2 emissions and renewable energy, economic growth, and population size, providing insights into the environmental and economic interactions specific to the region. Existing research does not sufficiently explore the specific effects of electricity and petroleum consumption in Eastern Africa, where energy diversification, security, and reliable electricity supply are challenges. The objective of this research is to evaluate the effects of these energy types on regional economic growth, providing guidance for energy investments and plans to promote regional economic advancement and comprehensive utilization of energy resources.

3. Methodology

This study utilizes data from twelve Eastern African countries: Burundi, Djibouti, Ethiopia, Kenya, Madagascar, Mauritius, Mozambique, Rwanda, South Sudan, Sudan, Tanzania, and Uganda. These countries were selected due to their diverse economic structures, political landscapes, and energy profiles, which provide a comprehensive view of the region’s energy-growth dynamics. This diversity allows the study to capture variations in energy consumption and economic growth across different contexts, making the findings more generalizable across Eastern Africa [

48]. For example, the inclusion of both landlocked nations, such as Rwanda and Uganda, and coastal nations, such as Kenya and Mauritius, provides valuable insights into how geographic location influences energy access and economic activity. Additionally, contrasting degrees of urbanization (e.g., Ethiopia’s rapid urbanization versus Burundi’s predominantly agricultural economy) offer a richer perspective on the interaction between energy consumption and economic structure [

49]. Additionally, contrasting energy profiles are considered, from countries like Kenya, which is actively investing in electrification and renewable energy projects, to those like South Sudan, which are significantly reliant on petroleum imports due to limited infrastructure [

12]. This comprehensive selection of countries allows for a more nuanced understanding of the relationship between electricity and petroleum consumption and economic growth in the region.

The period from 2000 to 2021 was chosen because it captures significant economic transitions in Eastern Africa, including the adoption of the Millennium Development Goals (MDGs) and Sustainable Development Goals (SDGs), which have shaped regional energy and economic policies. Additionally, during this time, Eastern Africa experienced increased regional integration through trade blocs like the East African Community and COMESA, along with the introduction of development integration agreements. This period allows for the analysis of energy consumption and economic growth during a time of rapid industrialization and urbanization, making it ideal for understanding both short-term fluctuations and long-term trends [

49,

50]. This timeframe is appropriate for understanding the evolving dynamics between energy consumption and economic growth in the context of regional development initiatives.

3.1. Data Sources and Variables

The study employs secondary data obtained from various databases. Economic data were sourced from the World Development Indicators, and energy consumption statistics were derived from the U.S. Energy Information Administration. A rigorous data validation process was undertaken to compare GDP growth and energy consumption figures across sources such as the International Monetary Fund, the United Nations Statistical Division, and the International Energy Agency. Demographic data were validated through comparison with the United Nations’ World Population Prospects. This comprehensive validation of data sources is crucial for ensuring the accuracy and reliability of the results [

51]. The study utilizes the yearly percentage increase in per capita Gross Domestic Product (GDP) as the dependent variable, which is a standard measure of economic growth. Electricity and petroleum were selected as key independent variables based on their fundamental role in driving economic activities within the Eastern African context. These two energy sources are critical in sectors such as manufacturing, transportation, and services, which are heavily depend on these energy for the region’s economic growth [

51,

52].

Eastern Africa’s growing urbanization and industrialization have increased demand for these energy sources, yet the region faces energy deficits and high reliance on petroleum imports [

53]. By focusing on these variables, this study addresses gaps in the literature where the distinct impacts of electricity and petroleum on economic growth in Eastern Africa have not been sufficiently explored. Capital and labour are included as independent variables in accordance with neoclassical growth theory, which posits that economic growth is driven by these two inputs. In the context of Eastern Africa, where labour-intensive industries and varying levels of capital investment play significant roles in economic growth, these variables are essential for understanding the full scope of factors that influence growth. Additionally, energy prices, measured through the consumer price index (CPI), are included as a control variable to account for the impact of energy price volatility on consumption patterns and economic performance, as supported by previous studies, e.g., [

52]. See below for a detailed description.

. Description of Variables.

This study employs three sequential steps to ensure robust results. The first step involves unit root testing to assess the stationarity of the panel data. The Hadri LM, Im-Pesaran-Shin, and Breitung tests are used due to their ability to handle heterogeneity across countries and account for the temporal dynamics inherent in panel data. These tests were chosen because they address potential cross-sectional dependence and structural breaks, which, if unaccounted for, could bias the estimation results [

50,

53]. These diagnostic tests confirm the stability of the data, reducing the need for explicit structural break tests. The unit root tests are conducted at both the level and first difference, as seen in similar studies by Nandan and Mallick [

54,

55] and Firtescu et al. [

56]. The second step involves the use of Panel Autoregressive Distributed Lag (ARDL) methods, which are appropriate for mixed cross-country time series data. The ARDL model was selected because it adeptly captures both short-term fluctuations and long-term equilibrium relationships between energy consumption and economic growth, even when variables are integrated at different levels (I(0) or I(1)) [

57]. This approach is particularly suitable for Eastern African countries due to the evolving nature of energy use and economic change in the region. The third step involves diagnostic tests such as the Hausman test, which is used to determine the most reliable estimator between the fixed effects and random effects models. This step ensures that the selected model is appropriate and not subject to misspecification biases [

58].

3.3. Estimation Models

This study employs the Panel Autoregressive Distributed Lag (ARDL) modeling approach to explore the effects of electricity and petroleum consumption on economic growth in Eastern Africa regions. This approach was chosen for its ability to incorporate lagged independent variables, which helps mitigate issues like omitted variable bias, measurement errors, and endogeneity as stated by Pesaran and Smith (1995) and cited by recent study of Adom et al. [

59]; Aïssaoui and Fabian [

60] and Wang et al. [

61]. Additionally, the ARDL model allows for a detailed examination of both short-term and long-term dynamics, which is essential given the varying economic conditions across the region. The study employs the Pooled Mean Group (PMG), Mean Group (MG), and Dynamic Fixed Effect (DFE) estimation techniques to capture the diverse economic realities of Eastern Africa. The PMG estimator is favored for its ability to estimate long-term relationships, making it suitable for a region like Eastern Africa, where short-term energy consumption patterns may vary significantly across countries but long-term growth trajectories are likely to exhibit common trends [

59]. The MG estimator allows us to assess country-specific responses, essential for understanding how countries with different levels of industrialization and energy infrastructure respond to external economic shocks [

62].

Finally, the DFE estimator provides insights into how the region as a whole reacts to global economic shocks in the short term, adding another dimension to the analysis. By applying these estimators, this study captures the nuanced interactions between energy consumption and economic growth in a region that exhibits both heterogeneity and interconnectedness [

63]. The MG estimator, on the other hand, is useful for capturing country-specific responses to external factors such as economic shocks or policy decisions. This is important for understanding how heterogeneous external factors influence economic growth in different contexts. Consequently, the PMG estimator, in particular, is emphasized in this study on the basis of diagnostic test results. Thus, the application of the PMG estimator has dominated study results and yields reliable insights [

64,

65], as indicated in baseline Equation (1).

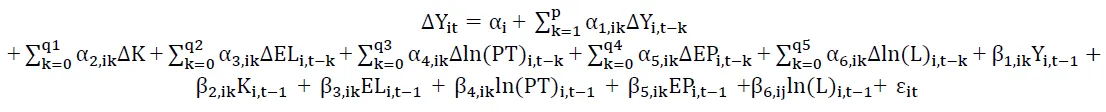

where Y represents an output which reflects the economic growth and measure by GDP, K is capital formation, L is labour, P is energy price, and EL and PT are electricity and petroleum consumption and the subscript i (i = 1, 2,..., n) refers to countries while t (t = 1, 2,..., T) refers to the time period.

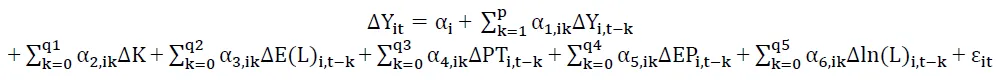

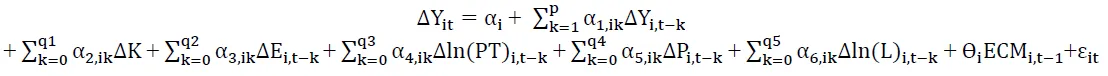

Furthermore, the ARDL estimation equation formulated into a panel of (p,q), where p represents the lags of the dependent variable and q represents the lags of the independent variables described as follows:

where α

i represents the fixed effects, α

1−α

6 is the lagged coefficients of the independent variables and the regressors and ε

it is the error term which is assumed to be white noise and varies across countries and time. Variables with coefficient α, show the short run dynamic, whereas the β, represents the long run dynamics. Thus, the null hypothesis in the equation is β

1, β

2, β

3, β

4, β

5, β

6 = 0, which means there is co-integration relationship. The rejection of null hypothesis (means that there is a long run relationship) and we proceed further to calculate the long run coefficients using the following model;

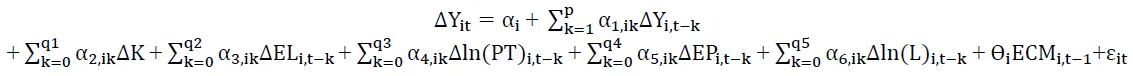

Once, a long-run relationship is established between the dependent variables and the regressors, the panel ECM model expressed in Equation (4) as follows:

where Ө is the coefficient of the error correction term which shows how quickly it is possible to achieve the equilibrium in the long run. The optimal lag length of the ECM in Equation (4) is determined using Akaike’s lag selection criteria and a maximum lag length of two is chosen.

3.4. Estimation Equations

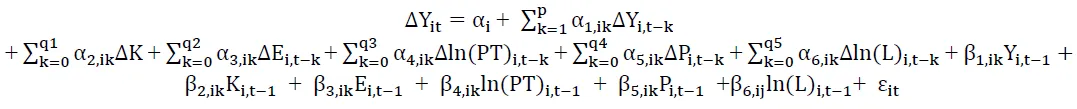

The estimation equation is operationalized through parameters (p,q), where ‘p’ signifies the lags of the dependent variable and ‘q’ symbolizes the lags of the independent variables as presented in Equation (5).

where α

i represents the fixed effects, α

1−α

6 is the lagged coefficients of the independent variables and the regressors and ε

it is the error term which is assumed to be white noise and varies across countries and time. Variables with coefficients α

1 through α

6 represent the short-run dynamics, while coefficients β

1 through β

6 capture the long-run dynamics. Consequently, the null hypothesis for the cointegration test stipulates that β

1 = β

2 = β

3 = β

4 = β

5 = β

6 = 0, indicating no cointegration relationship. A rejection of this null hypothesis suggests the presence of a long-term relationship among the variables.

After presenting the dynamics relationship equation between the variables, the face of short-run disequilibrium is captured by introducing an error correction term (ECT) in Equation: captures how deviations from long-run equilibrium are corrected each period, where a negative value indicates a correction towards equilibrium, reflecting the stability of the long-run relationship. The magnitudes informs about the speed of this adjustment process, with a more negative value suggesting a faster return to equilibrium. Therefore, the long-run relationship model specified in Equation (6).

where Ө

i is the coefficient of the error correction term, the optimal lag length of the ECM is determined using Akaike’s lag selection criteria, with a maximum lag length of two.

As a result, by incorporating three estimation techniques Pooled Mean Group (PMG), Mean Group (MG), and Dynamic Fixed Effect (DFE), this study provides a thorough examination of the energy-economic growth nexus, taking into account both country-specific and regional trends.The PMG estimator, in particular, is emphasized due to its superior performance in terms of consistency and efficiency, as confirmed by diagnostic tests such as the Hausman test [

63].

4. Results and Discussion

4.1. Descriptive Statistics and Test

displays descriptive statistics, showing significant variations in key economic indicators. GDP growth ranges from −93.42 in South Sudan to 10.561 in Rwanda. This reflects diverse economic trajectories, likely influenced by differences in political stability, presence of conflict, natural resource endowments, and economic policies. For instance, South Sudan’s negative growth could be partly attributed to on-going conflict and political instability, while Rwanda’s growth may stem from successful economic reforms and political stabilization efforts. Energy consumption also varies, with petroleum being three times higher than electricity, indicating different energy usage patterns that could be shaped by factors such as infrastructure development and resource availability. Price levels vary, with South Sudan having the lowest and Ethiopia having the highest. These descriptive results confirm heterogeneity in the panel data, leading to the application of the Panel Autoregressive Distributed Lag model, which accommodates diverse data series, captures heterogeneity, and provides robust results on the relationships between economic growth and energy consumption.

. Descriptive Statistics.

To ensure the robustness of the study findings, this study conducted a series of diagnostic tests prior to the empirical analysis. The analysis begins by examining the pairwise correlations between variables to identify multicollinearity issues. Subsequently, potential contamination of results due to endogeneity is addressed by employing the Panel Autoregressive Distributed Lag (ARDL) model, which incorporates lagged independent variables, helping mitigate reverse causality and omitted variable bias. The use of dynamic estimators further corrects for endogeneity and unobserved heterogeneity. Further, the analysis examines the presence of cross-sectional dependence and determines the order of integration of each variable using panel unit root tests. This approach accounts for potential interdependencies among the Eastern African countries included.

, presents the correlation matrix and multicollinearity diagnostics for the study variables. The analysis reveals weak to moderate positive correlations between most variables. Importantly, all Pearson correlation coefficients are below 0.8, indicating an acceptable level of independence among the independent variables for regression analysis. Although a positive correlation (0.68) exists between petroleum and electricity consumption, potentially reflecting shared economic drivers, diagnostic tests including variance inflation factors (VIFs) confirm low multicollinearity. These values range from 1.01 to 2.09, supporting the absence of multicollinearity issues. These findings are consistent with earlier studies by [

66,

67].

. Correlations and Multicollinearity.

presents the results of cross-sectional dependency tests and the CADF panel unit root tests conducted on the variables of interest. The Breusch-Pagan LM, Pesaran CD, and Friedman tests consistently reject the null hypothesis of no cross-sectional dependence across all variables, highlighting significant economic linkages among the Eastern African countries in our study. This interconnectedness, likely driven by spillover effects or common unobserved factors, implies that economic or energy-related shocks in one country can potentially influence others. Given this confirmed cross-sectional dependence, we employ the Cross-Sectionally Augmented Dickey-Fuller panel unit root test, which is robust to such dependence and provides more consistent results than traditional unit root tests. The CADF test determines the stationarity of the variables, indicating at which level of integration they become stationary, while accounting for cross-sectional dependence.

. Panel Unit Root Tests for Cross-Section Dependency.

The CADF test results indicate that the null hypothesis of non-stationarity is rejected for lnLabour and lnPetroleum at the level, suggesting these variables are stationary at level I. Conversely, the null hypothesis cannot be rejected for GDP, Capital, Price, and Electricity, indicating these variables are non-stationary at the level but become stationary at the first difference, denoted as I. These findings support the use of first-differenced data for GDP, Capital, Price, and Electricity in subsequent analyses, while lnLabour and lnPetroleum can be used in their levels. The robustness of the CADF test to cross-sectional dependence ensures the reliability of Panel ARDL models for further analysis, as these models effectively account for such dependence, ensuring efficient and reliable results.

In selecting the appropriate estimations model, the study employs the Hausman test. The test is crucial in panel ARDL contexts for distinguishing between fixed effects and random effects models, guiding the choice among pooled mean group, mean group, and dynamic fixed effects estimators. The null hypothesis in both PMG versus MG and PMG versus DFE comparisons assumes homogeneous long-run coefficients and consistent short-run dynamics across countries. A

p-value above the conventional thresholds (such as 0.05 or 0.10) would support the null hypothesis, suggesting the PMG’s assumptions hold true. The Hausman test results comparing PMG with MG revealed a χ

2 statistic of 1.04 with a

p-value of 0.9 indicating support for the null hypothesis favouring the PMG model’s ability to control unobserved heterogeneity. Conversely, the PMG compared with DFE yielded a negative χ

2 statistic of −6.77. The occurrence of a negative χ

2 statistic is unexpected, as it indicates potential discrepancies in the variance-covariance matrices. Such negative χ

2 value is interpreted in line with existing literature to mean that a more efficient estimator aligns with the null hypothesis, indicating that differences in coefficients between PMG and DFE models are not systematic. Therefore, the PMG estimator provides a robust basis for the discussion, conclusions, and recommendations presented.

4.2. Presentation of Results

shows the results of Panel ARDL (2 2 2 1 2 0), which has been employed to address endogeneity effects to possible reverse causality between energy consumption and GDP in the regions of study. In addressing endogeneity concerns, the use of lagged variables in the ARDL model provides a solution to possible reverse causality between energy consumption and GDP, as the model considers both short-term and long-term dynamics. In all three models, the Error Correction Term (ECT) is statistically significant at the 1% level, enabling the estimation of both short- and long-run impacts across the models. Moreover, the negative sign of the ECT coefficients in all three models implies a corrective response of the variables toward long-run equilibrium following short-term shocks, as also evidenced by [

27]. The statistical importance of the ECT coefficients indicates a long-run equilibrium relationship between the variables in each of the models. This suggests the variables converge to their long-run equilibrium post any short-term disparities. Additionally, the negative sign of the ECT coefficients is similarly reflected in the findings by [

39], implying a regulative adjustment of the variables in the reverse direction of the deviation. Larger absolute values of the ECT coefficients denote more rapid adjustments, while smaller values indicate a slower realignment process. Consequently, the study asserts the presence of a long-run relationship and a corresponding adjustment mechanism between variables in all models, signifying their interdependence in the short run and a systematic correction to equilibrium in the long run.

The findings reveal that petroleum consumption significantly impacts GDP in both the short and long run. In the short run, all three models demonstrate a positive association between petroleum consumption and GDP growth. Specifically, a 1% increase in petroleum consumption is associated with GDP increases ranging from 0.073 to 0.121 units in the PMG and MG models, respectively (

p < 0.05). The DFE model shows a similar positive impact, with a 1% increase in petroleum consumption associated with a 0.083 unit increase in GDP (

p < 0.01). These results highlight the immediate positive effect of changes in petroleum consumption on economic growth. In the long run, the PMG model further reveals a significant positive relationship, indicating that a one-unit increase in petroleum consumption is associated with a 0.031 unit increase in GDP (

p < 0.01). These findings underscore the crucial role of petroleum consumption in driving both short-term and long-term economic growth.

. Results of Panel ARDL (2 2 2 1 2 0).

In the short run, the results of electricity consumption on GDP lack statistical significance, despite a positive association suggesting a potentially beneficial impact on economic growth. On the other hand, the long-run analysis reveals a statistically significant negative relationship between electricity consumption and GDP growth with an estimated coefficient of −0.369 (

p < 0.05). This implies that a 1% increase in electricity consumption corresponds to a 0.369 unit decrease in GDP. This study reveals a consistently statistically significant negative relationship between energy price indexes and GDP at a 1% significance level across both short- and long-run periods. Specifically, the results indicate that a 1% increase in energy prices is associated with a 0.00321 unit decrease in GDP in the short run, while long-run estimates suggest that a 1% increase in prices corresponds to a decrease of approximately 0.0041 units in GDP. The consistent negative relationship aligns with economic intuition; higher energy prices can reduce consumer purchasing power and overall economic activity. However, it is noteworthy that the statistically significant negative relationship was observed only in the DFE model. This might be attributed to the model’s ability to account for cross-sectional dependence or individual effects within the study panels.

This study reveals contrasting impacts of labour and capital on GDP across different time horizons, with significance observed at the 1% level. Specifically, under the DFE model, a 1% increase in labour is associated with a 1.894 unit increase in GDP in the short run. However, long-run PMG estimates indicate statistically significant negative relationships for both labour and capital. The long-run analysis suggests that a 1% increase in labour corresponds to a 0.09540 unit decrease in GDP, while a 1% increase in capital corresponds to a 0.0145 unit decrease. This shift from a positive short-run to a negative long-run relationship for labour, alongside the consistently negative association with capital, highlights the complex dynamics of economic growth. These findings suggest the potential for diminishing returns over time and underscore the PMG model’s ability to capture these long-run effects, in contrast to the DFE model.

4.3. Discussion of Results

Our findings energy consumption demonstrates a positive impact on GDP growth in Eastern Africa regions, both in the short and long run. In the short run, this is primarily attributed to the region’s heavy reliance on petroleum for transportation and as a primary energy source across various sectors, including manufacturing, industry, and services. However, this dependence creates a cyclical pattern in which economic growth stimulates oil demand, further entrenching dependence and exposing the region to volatile global oil prices. Notably, these findings align with those of Odhiambo [

38], who similarly reported positive relationships between petroleum consumption and economic growth. Additionally, Rahman et al. [

63] utilized three models for energy analysis, and confirmed the positive influence of energy sources on GDP growth. These finding amplified over the long run by existing infrastructure deficits, particularly in the energy sector, which necessitate the use of petroleum-powered. East Africa’s industrialization sectors heavily depend on petroleum and electricity, such as manufacturing and mining. To address these challenges, intervening in available energy sources presents a key opportunity for the African region to accelerate economic growth while reducing dependence on petroleum. The introduction of innovation for renewable energy technologies interventions, such as that of the Stiegler Gorges Dam project in Tanzania, could help stabilize energy supplies, reduce operating costs, mitigate environmental impacts, and likely stimulate economic growth in the regions. Furthermore, innovation in renewable energy technologies provides an opportunity for energy diversification, which could significantly influence the pace of economic growth in the region. In the short term, our findings on electricity consumption showed a positive relationship, suggesting a potentially positive impact on economic growth, while in the long term, a statistically significant negative relationship was revealed between electricity consumption and GDP growth, which may be due to the early phase of energy intervention projects in the regions. The findings show that petroleum consumption has a significant impact on GDP in both the short and long run. In the short run, all three models demonstrate a positive relationship between petroleum consumption and GDP growth in the regions. These findings align with those of Topcu et al. [

34] and Lawal et al. [

37], who also observed positive long-run effects of energy consumption on economic growth. According to the reports from the International Renewable Energy Agency (IRENA), sub-Saharan African countries could meet up to 50% of their electricity needs with renewable energy by 2030 if investment in infrastructure and innovation is prioritized. Therefore, policymakers must balance the short-term benefits of petroleum-based fuels with long-term strategies that promote diversification and sustainability in the energy sector.

In this case, the lack of short-term statistical significance may reflect the lagged effects of electricity infrastructure development or the time required for businesses to fully leverage improved electricity availability. Economic theory suggests that infrastructure investments, such as those in electricity generation, often require time to generate measurable economic returns. Initial investments may face diminishing returns due to inefficiencies or delayed productivity improvements, which can explain why the impact of electricity consumption on economic growth may not be immediate. However, the negative long-run relationship, where increased electricity consumption appears to hinder economic growth, indicates a more nuanced situation. This counterintuitive finding could be attributed to several systemic challenges. For example, inefficiencies in electricity generation and distribution, common in developing economies, result in significant energy losses. According to reports from the International Energy Agency (IEA), some Eastern African countries experience transmission and distribution losses as high as 20–30%, which increases operational costs for businesses. Additionally, the electricity generated might be channeled predominantly towards less productive sectors or utilized inefficiently, limiting its contribution to overall economic output. Low energy efficiency in key industries might mean that even with more electricity available, productivity gains and economic output do not increase proportionally.

Furthermore, the region’s struggle with unreliable electricity supply could be a factor. Frequent outages disrupt industrial processes, discourage investment, and force businesses to rely on costly backup generators, ultimately hindering economic growth. These outages have been documented in various reports, such as the World Bank’s Enterprise Surveys, which highlight that unreliable electricity is one of the top constraints to doing business in Sub-Saharan Africa. Developing renewable energy technologies, combined with innovation in storage and grid management systems, could mitigate these issues, providing a more reliable and cost-effective energy supply. These findings underscore the need for a multi-pronged approach to electricity sector development in Eastern Africa. Investing in modern, efficient electricity generation from renewable sources like solar, wind, and geothermal can provide a cleaner and more sustainable energy mix. Simultaneously, modernizing the electricity grid to reduce transmission and distribution losses is crucial. Although short-term statistical significance may not always be present, the long-term implications of inefficient energy use are clear. The policy recommendations stemming from this analysis are crucial for addressing both immediate and longer-term challenges. Incorporating renewable energy innovations into existing infrastructure and prioritizing investment in new technologies can not only enhance industrial productivity but also create a more resilient and sustainable energy sector. Therefore, policymakers must prioritize investments in renewable energy, grid modernization, and energy efficiency programs. Additionally, these innovations create significant opportunities for private sector investment and public-private partnerships that could further accelerate the pace of economic growth. For the public, improvements in the electricity infrastructure would mean more reliable and affordable energy access. These improvements would not only enhance industrial productivity but also lead to more reliable and affordable electricity access for households. Investors may see opportunities in renewable energy projects, given the region’s current reliance on petroleum and the need for a diversified energy portfolio to stabilize economic growth in the long run. The energy sector, particularly renewable energy, presents an attractive investment opportunity, especially as the region transitions toward sustainable energy solutions to address inefficiencies in electricity production and distribution.

These efforts would not only enhance industrial productivity but also create a more resilient and sustainable energy sector that supports long-term economic growth. For the public, improvements in the electricity infrastructure would mean more reliable and affordable energy access. These improvements would not only enhance industrial productivity but also lead to more reliable and affordable electricity access for households. Investors may see opportunities in renewable energy projects, given the region’s current reliance on petroleum and the need for a diversified energy portfolio to stabilize economic growth in the long run. The energy sector, particularly renewable energy, presents an attractive investment opportunity, especially as the region transitions toward sustainable energy solutions to address inefficiencies in electricity production and distribution. However, these findings contrast with previous studies, which generally reported positive associations between electricity consumption and economic growth [

37,

38].

The finding that labour and capital exhibit negative long-run relationships with economic growth in Eastern Africa presents unexpected results, contradicting traditional economic theory and numerous empirical studies like of ref. [

68,

69] that emphasize these factors as key drivers of prosperity. Traditionally, economic models like the Solow-Swan model and the Cobb-Douglas production function predict a positive relationship between these inputs and GDP growth, anticipating that increases in either labour or capital drive economic expansion. While both labour and capital might show initial promise in stimulating growth, these regional results reveal a concerning trend. These unexpected results could stem from persistent structural bottlenecks within Eastern African economies. For instance, diminishing returns to scale for both labour and capital might arise from skill gaps in the workforce, limiting labour productivity, or from inefficient allocation of capital, hindering its effective utilization in productive activities. Furthermore, the lack of technological progress plays a crucial role. Without continuous innovation and adoption of productivity-enhancing technologies, simply increasing labour and capital inputs might not translate into sustained economic growth, potentially leading to the observed negative long-run relationships. These findings underscore the need for a strategic approach to development policy in the region, one that moves beyond merely increasing labour and capital inputs. Instead, prioritizing investments in education and skills development to enhance labour productivity, alongside promoting technological innovation and ensuring efficient allocation of capital, is essential to maximize returns on investment. Addressing these structural constraints is crucial for transitioning from a factor-driven to a productivity-driven growth model, ultimately unlocking Eastern Africa’s full economic potential.

4.4. Study Limitations

The findings of this study regarding the effects of electricity and petroleum consumption on GDP are specific to the Eastern African sub-region. Therefore, caution should be exercised when extrapolating these results to other regions, due to the unique economic, political, environmental, and infrastructural factors of Eastern Africa. These considerations encompass, among others, particular energy policies and decisions, the extent of energy infrastructure build-up, and unique market forces that might not exist or vary greatly in different settings. Such regional disparities may result in different relationships between energy consumption and GDP growth elsewhere.

5. Conclusions and Policy Implications

5.1. Conclusions

This study reveals a complex relationship between energy consumption and economic growth in Eastern Africa. While petroleum emerges as a significant driver of short- and long-run GDP growth, this dependence raises concerns about sustainability and exposes the region to volatile global oil prices. Furthermore, simply expanding electricity access without addressing sector-specific challenges may not guarantee sustained economic benefits. Unexpectedly, the study also finds a negative long-run relationship between traditional inputs (labour and capital) and economic growth, challenging the effectiveness of factor-driven models in the region. These findings underscore the need for tailored policy interventions that promote energy source diversification, enhance energy efficiency, and prioritize investments in lobour band technological progress to unlock sustainable and inclusive growth in Eastern Africa.

5.2. Policy Implications

This study’s findings highlight key policy priorities for sustainable growth in Eastern Africa. While petroleum currently fuels the economy, its volatility necessitates a two-pronged approach: diversifying energy sources by investing in renewables like solar and wind, and drastically improving energy efficiency across all sectors. Furthermore, expanding electricity access alone is insufficient; reforming the sector to reduce losses, improve infrastructure, and attract private investment is equally critical. Finally, shifting away from factor-driven growth models is essential. Prioritizing investments in human capital, particularly education and skills development, alongside fostering innovation and technological progress, will be crucial for achieving sustainable and inclusive growth in the region.

5.3. Avenues for Future Research

This study identifies several avenues for further investigation. Disaggregating energy consumption data by economic sector would provide a nuanced understanding of sector-specific energy efficiency and its impact on growth. Further research is needed to pinpoint the specific factors driving the observed relationships between energy consumption and economic growth. Additionally, quantifying the impact of electricity sector bottlenecks, such as transmission losses and inefficient end-use practices, alongside analysing the temporal dynamics of electricity infrastructure investments, will be crucial for informing effective energy policies in Eastern Africa.

Acknowledgments

The authors extend their gratitude to the Local Government Training Institute and Moshi Cooperative University for their invaluable support, particularly through access to library services, private workspaces, data resources, and dedicated time throughout this study. We are also thankful for the in-kind contributions that significantly facilitated the research process.

Author Contributions

N.F.M. participated in the conception and design of the study; data cleaning; data analysis; interpretation of the findings; and drafting and revising the manuscript. Y.J.K. participated in conception and design, data analysis, interpreting the findings; and revising the paper.

Ethics Statement

Not applicable. This study did not involve humans or animals.

Informed Consent Statement

Not applicable.

Funding

This research received no external funding, however, we acknowledge financial support from the Local Government Training Institute.

Declaration of Competing Interest

The authors declare that they have no competing interests.

References

1.

Mohsin M, Kamran HW, Nawaz MA, Hussain MS, Dahri AS. Assessing the impact of transition from nonrenewable to renewable energy consumption on economic growth-environmental nexus from developing Asian economies.

J. Environ. Manag. 2021,

284, 111999. doi:10.1016/j.jenvman.2021.111999.

[Google Scholar]

2.

Martínez AP, Jara-Alvear J, Andrade RJ, Icaza D. Sustainable development indicators for electric power generation companies in Ecuador: A case study.

Util. Policy 2023,

81, 101493. doi:10.1016/j.jup.2023.101493.

[Google Scholar]

3.

Halkos G, Gkampoura EC. Where do we stand on the 17 Sustainable Development Goals? An overview on progress.

Econ. Anal. Policy 2021,

70, 94–122. doi:10.1016/j.eap.2021.02.001.

[Google Scholar]

4.

Abbasi KR, Shahbaz M, Jiao Z, Tufail M. How energy consumption, industrial growth, urbanization, and CO

2 emissions affect economic growth in Pakistan? A novel dynamic ARDL simulations approach.

Energy 2021,

221, 119793. doi:10.1016/j.energy.2021.119793.

[Google Scholar]

5.

Kahia M, Jebli MB, Belloumi M. Analysis of the impact of renewable energy consumption and economic growth on carbon dioxide emissions in 12 MENA countries.

Clean Technol. Environ. Policy 2019,

21, 871–885. doi:10.1007/s10098-019-01676-2.

[Google Scholar]

6.

International Energy Outlook 2019 with Projections to 2050. Available online: https://www.eia.gov/outlooks/ieo/pdf/ieo2019.pdf (accessed on 1 September 2024).

7.

IEA. Africa Energy Outlook 2019—Analysis and Key Findings. A Report by the International Energy Agency. 2019. Available online: www.iea.org/africa2019%0Ahttps://www.oecd-ilibrary.org/energy/africa-energy-outlook_g2120ab250-en%0Ahttps://www.iea.org/africa2019 (accessed on 1 September 2024).

8.

British Petroleum. Statistical Review of World Energy Globally Consistent Data on World Energy Markets and Authoritative Publications in the Field of Energy. 2020. Available online: https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/statistical-review/bp-stats-review-2020-full-report.pdf (accessed on 1 September 2024).

9.

Qudrat-Ullah H, Nevo CM. The impact of renewable energy consumption and environmental sustainability on economic growth in Africa.

Energy Rep. 2021,

7, 3877–3886.

[Google Scholar]

10.

Houeninvo T. African Development Bank African Development Fund Republic of Uganda Country Strategy Paper 2022-26 Report Peer Reviewers Toussaint Houeninvo East Africa Regional Development and Business Delivery Office February 2022 Political Context and Prospects. 2022. Available online: https://scholar.google.com/scholar?hl=en&as_sdt=0%2 C5&q=African+development+bank+african+development+fund+republic+of+uganda+country+strategy (accessed on 30 October 2024).

11.

Muazu A, Yu Q, Liu Q. Does renewable energy consumption promote economic growth? An empirical analysis of panel threshold based on 54 African countries.

Int. J. Energy Sect. Manag. 2023,

17, 106–127. doi:10.1108/IJESM-09-2021-0003.

[Google Scholar]

12.

Monyei CG, Akpeji KO, Oladeji O, Babatunde OM, Aholu OC, Adegoke D, et al. Regional cooperation for mitigating energy poverty in Sub-Saharan Africa: A context-based approach through the tripartite lenses of access, sufficiency, and mobility.

Renew. Sustain. Energy Rev. 2022,

159, 112209. doi:10.1016/j.rser.2022.112209.

[Google Scholar]

13.

Bokoro PN, Kyamakya K. The Impact of Market-Based Policies on Access to Electricity and Sustainable Development in Sub-Saharan Africa. In Recent Advances in Energy Systems, Power and Related Smart Technologies. Studies in Systems, Decision and Control; Kyamakya K, Bokoro PN, Eds; Springer: Cham, Switzerland, 2024; Volume 472. doi:10.1007/978-3-031-29586-7_13.

14.

Tom Remy T, Chattopadhyay D. Promoting better economics, renewables and CO

2 reduction through trade: A case study for the Eastern Africa Power Pool.

Energy Sustain. Dev. 2020,

57, 81–97.

[Google Scholar]

15.

Nepal R, Musibau HO. Energy security, renewable, non-renewable energy and economic growth in asean economies: New insights.

Singap. Econ. Rev. 2021,

66, 457–488. doi:10.1142/S0217590819430045.

[Google Scholar]

16.

Chen Y, Mamon R, Spagnolo F, Spagnolo N. Sustainable developments, renewable energy, and economic growth in Canada.

Sustain. Dev. 2023,

31, 2950–2966. doi:10.1002/sd.2561.

[Google Scholar]

17.

Orlando G, Sportelli M, Della Rossa F. The Harrod Model.

Dyn. Model. Econom. Econ. Financ. 2021,

29, 177–189. doi:10.1007/978-3-030-70982-2_13.

[Google Scholar]

18.

Chetty VK, Pradhan BK. Harrod-Domar Formula for Two Sector Growth Models; Institute of Economic Growth, University Enclave, University of Delhi: New Delhi, India, 2020.

19.

United Nations. Energy Statistics Pocketbook 2022. Statistics Papers, Serie E N°5. In United Nation Publications. 2022. Available online: https://unstats.un.org/unsd/energystats/pubs/pocketbook/ (accessed on 1 September 2024).

20.

Onyango G, Hyden G. Governing Kenya: Public Policy in Theory and Practice; Springer: Cham, Switzerland, 2021.

21.

Mose N. Determinants of Regional Economic Growth in Kenya.

Afr. J. Bus. Manag. 2021,

15, 1–12. doi:10.5897/AJBM2020.9118.

[Google Scholar]

22.

Chen C, Pinar M, Stengos T. Renewable energy consumption and economic growth nexus: Evidence from a threshold model.

Energy Policy 2020,

139, 111295.

[Google Scholar]

23.

Kober T, Schiffer HW, Densing M, Panos E. Global energy perspectives to 2060—WEC’s World Energy Scenarios 2019.

Energy Strategy Rev. 2020,

31, 100523. doi:10.1016/j.esr.2020.100523.

[Google Scholar]

24.

Petrakis PE. Theoretical Approaches to Economic Growth and Development: An Interdisciplinary Perspective, No. November 2020. Available online: https://link.springer.com/book/10.1007/978-3-030-50068-9 (accessed on 1 September 2024).

25.

Kulindwa Y.J., Ahlgren E.O. Households and tree-planting for wood energy production—Doperceptions matter?

For. Policy Econ. 2021,

130, 103739. doi:10.1016/j.forpol.2021.102528.

[Google Scholar]

26.

Shiozawa Y. A new framework for analyzing technological change.

J. Evol. Econ. 2020,

30, 989–1034. doi:10.1007/s00191-020-00704-5.

[Google Scholar]

27.

Mensah IA, Sun M, Gao C, Omari-Sasu AY, Zhu, D, Ampimah BC, et al. Analysis on the nexus of economic growth, fossil fuel energy consumption, CO

2 emissions and oil price in Africa based on a PMG panel ARDL approach.

J. Clean. Prod. 2019,

228, 161–174. doi:10.1016/j.jclepro.2019.04.281.

[Google Scholar]

28.

Bosah CP, Li S, Ampofo GKM, Liu K. Dynamic nexus between energy consumption, economic growth, and urbanization with carbon emission: Evidence from panel PMG-ARDL estimation.

Environ. Sci. Pollut. Res. 2021,

28, 61201–61212. doi:10.1007/s11356-021-14943-x.

[Google Scholar]

29.

Abdul-Mumuni A, Mensah BD, Amankwa Fosu R. Asymmetric effect of renewable energy consumption and economic growth on environmental degradation in sub-Saharan Africa.

Int. J. Energy Sect. Manag. 2023,

17, 1013–1033. doi:10.1108/IJESM-07-2022-0009.

[Google Scholar]

30.

Destek MA, Okumus I. Disaggregated energy consumption and economic growth in G-7 countries.

Energy Sources Part B Econ. Plan. Policy 2017,

12, 808–814. doi:10.1080/15567249.2017.1286527.

[Google Scholar]

31.

Ozcan B, Tzeremes PG, Tzeremes NG. Energy consumption, economic growth and environmental degradation in OECD countries.

Econ. Model. 2020,

84, 203–213. doi:10.1016/j.econmod.2019.04.010.

[Google Scholar]

32.

Tzeremes P. Time-varying causality between energy consumption, CO

2 emissions, and economic growth: Evidence from US states.

Environ. Sci. Pollut. Res. 2018,

25, 6044–6060. doi:10.1007/s11356-017-0979-x.

[Google Scholar]

33.

Behera J. Renewable and non-renewable energy consumption and economic growth in G7 countries: Evidence from panel autoregressive distributed lag (P-ARDL) model.

Int. Econ. Econ. Policy 2019,

17, 241–258.

[Google Scholar]

34.

Topcu E, Altinoz B, Aslan A. Global evidence from the link between economic growth, natural resources, energy consumption, gross capital formation.

Resour. Policy 2020,

66, 101622. doi:10.1016/j.resourpol.2020.101622.

[Google Scholar]

35.

Shafique M, Azam A, Rafiq M, Luo X. Investigating the nexus among transport, economic growth and environmental degradation: Evidence from panel ARDL approach.

Transp. Policy 2021,

109, 61–71. doi:10.1016/j.tranpol.2021.04.014.

[Google Scholar]

36.

Moutinho V, Madaleno M. Economic growth assessment through an ARDL approach: The case of African OPEC countries.

Energy Rep. 2020,

6, 305–311. doi:10.1016/j.egyr.2020.11.253.

[Google Scholar]

37.

Lawal AI, Ozturk I, Olanipekun IO, Asaleye AJ. Examining the linkages between electricity consumption and economic growth in African economies.

Energy 2020,

208, 118363. doi:10.1016/j.energy.2020.118363.

[Google Scholar]

38.

Odhiambo NM. Energy consumption and economic growth in Botswana: Empirical evidence from a disaggregated data.

Int. Rev. Appl. Econ. 2021,

35, 3–24. doi:10.1080/02692171.2020.1792851.

[Google Scholar]

39.

Erdogan S, Akalin G, Oypan O. Are shocks to disaggregated energy consumption transitory or permanent in Turkey? New evidence from fourier panel KPSS test.

Energy 2020,

197, 117174. doi:10.1016/j.energy.2020.117174.

[Google Scholar]

40.

Brini R. Renewable and non-renewable electricity consumption, economic growth and climate change: Evidence from a panel of selected African countries.

Energy 2021,

223, 120064. doi:10.1016/j.energy.2021.120064.

[Google Scholar]

41.

Yu B, Fang D, Meng J. Analysis of the generation efficiency of disaggregated renewable energy and its spatial heterogeneity influencing factors: A case study of China.

Energy 2021,

234, 121295. doi:10.1016/j.energy.2021.121295.

[Google Scholar]

42.

Murshed M, Ali SR, Banerjee S. Consumption of liquefied petroleum gas and the EKC hypothesis in South Asia: Evidence from cross-sectionally dependent heterogeneous panel data with structural breaks.

Energy Ecol. Environ. 2021,

6, 353–377. doi:10.1007/s40974-020-00185-z.

[Google Scholar]

43.

Bouznit M, Pablo-Romero MP, Sánchez-Braza A. Residential electricity consumption and economic growth in algeria.

Energies 2018,

11, 1656. doi:10.3390/en11071656.

[Google Scholar]

44.

Dogan E, Tzeremes P, Altinoz B. Revisiting the nexus among carbon emissions, energy consumption and total factor productivity in African countries: New evidence from nonparametric quantile causality approach.

Heliyon 2020,

6, e03566. doi:10.1016/j.heliyon.2020.e03566.

[Google Scholar]

45.

Etensa T, Taye L, Bersisa M. Infrastructure Development and Economic Growth in East Africa: Quantity versus Quality Dimensions Using Panel-ARDL Approach.

Int. J. Empir. Econ. 2022,

1, 2240001. doi:10.1142/s2810943022400017.

[Google Scholar]

46.

Tzeremes P. The impact of total factor productivity on energy consumption and CO2 emissions in G20 countries.

Econ. Bull. 2020,

40, 2179–2192.

[Google Scholar]

47.

Namahoro JP, Wu Q, Xiao H, Zhou N. The impact of renewable energy, economic and population growth on CO

2 emissions in the east african region: Evidence from common correlated effect means group and asymmetric analysis.

Energies 2021,

14, 312. doi:10.3390/en14020312.

[Google Scholar]

48.

Blimpo MP, Dato P, Mukhaya B, Odarno L. Climate Change and Economic Development in Africa: A Systematic Review of Energy Transition Research*.

Energy Policy 2023,

187, 114044. doi:10.1016/j.enpol.2024.114044.

[Google Scholar]

49.

Cobbinah PB, Addaney M. The Geography of Climate Change Adaptation in Urban Africa; no. February; Springer International Publishing: New York, NY, USA, 2019.

50.

Behera P, Sethi N. Nexus between environment regulation, FDI, and green technology innovation in OECD countries.

Environ. Sci. Pollut. Res. 2022,

29, 52940–52953. doi:10.1007/s11356-022-19458-7.

[Google Scholar]

51.

Brockway PE, Sorrell S, Semieniuk G, Heun MK, Court V. Energy efficiency and economy-wide rebound effects: A review of the evidence and its implications.

Renew. Sustain. Energy Rev. 2021,

141, 110781. doi:10.1016/j.rser.2021.110781.

[Google Scholar]

52.

Shahbaz M, Raghutla C, Chittedi KR, Jiao Z, Vo XV. The effect of renewable energy consumption on economic growth: Evidence from the renewable energy country attractive index.

Energy 2020,

207, 101168. doi:10.1016/j.energy.2020.118162.

[Google Scholar]

53.

Ozcan B, Ozturk I. Renewable energy consumption-economic growth nexus in emerging countries : A bootstrap panel causality test.

Renew. Sustain. Energy Rev. 2019,

104, 30–37. doi:10.1016/j.rser.2019.01.020.

[Google Scholar]

54.

Nandan A, Mallick H. Do Growth-Promoting Factors Induce Income Inequality in a Transitioning Large Developing Economy? An Empirical Evidence from Indian States; Springer US: New York, NY, USA, 2022; Volume 55, No. 2.

55.

Nandan A, Mallick H. Does Gender Equality Matter for Regional Growth and Income Inequality? An Empirical Analysis for the Indian States.

J. Int. Dev. 2020,

32, 439–469. doi: 10.1002/jid.3460.

[Google Scholar]

56.

Firtescu BN, Brinza F, Grosu M, Doaca EM, Siriteanu AA. The effects of energy taxes level on greenhouse gas emissions in the environmental policy measures framework.

Front. Environ. Sci. 2023,

10, 965841. doi:10.3389/fenvs.2022.965841.

[Google Scholar]

57.

Addaney M, Cobbinah P. Sustainable Urban Futures in Africa, 1st ed.; Routledge: New York, NY, USA; 2021. doi.org/10.4324/9781003181484.

58.

Jalil A, Rao NH. Time Series Analysis (Stationarity, Cointegration, and Causality); Elsevier: Amsterdam, The Netherlands, 2019.

59.

Adom PK, Agradi M, Vezzulli A. Energy efficiency-economic growth nexus: What is the role of income inequality?

J. Clean. Prod. 2021,

310, 127382. doi:10.1016/j.jclepro.2021.127382.

[Google Scholar]

60.

Aïssaoui R, Fabian F. Globalization, economic development, and corruption: A cross-lagged contingency perspective.

J. Int. Bus. Policy 2022,

5, 1–28. doi:10.1057/s42214-020-00091-5.

[Google Scholar]

61.

Wang J, Hassan MS, Alharthi M, Arshed N, Hanif I, Saeed MI. Inspecting non-linear behavior of aggregated and disaggregated renewable and non-renewable energy consumption on GDP per capita in Pakistan.

Energy Strateg. Rev. 2022,

39, 100772. doi:10.1016/j.esr.2021.100772.

[Google Scholar]

62.

Pesaran MH, Smith R. Estimating Long-Run Relationships from Dynamic Heterogeneous Panels.

J. Econom. 1995,

68, 79–113.

[Google Scholar]

63.

Rahman ZU, Khattak SI, Ahmad M, Khan A. A disaggregated-level analysis of the relationship among energy production, energy consumption and economic growth: Evidence from China.

Energy 2020,

194, 116836. doi:10.1016/j.energy.2019.116836.

[Google Scholar]

64.

Hongxing Y, Abban OJ, Boadi AD, Ankomah-Asare ET. Exploring the relationship between economic growth, energy consumption, urbanization, trade, and CO

2 emissions: A PMG-ARDL panel data analysis on regional classification along 81 BRI economies.

Environ. Sci. Pollut. Res. 2021,

28, 66366–66388. doi: 10.1007/s11356-021-15660-1.

[Google Scholar]

65.

Rahman MM, Nepal R, Alam K. Impacts of human capital, exports, economic growth and energy consumption on CO

2 emissions of a cross-sectionally dependent panel: Evidence from the newly industrialized countries (NICs).

Environ. Sci. Policy 2021,

121, 24–36. doi:10.1016/j.envsci.2021.03.017.

[Google Scholar]

66.

Nathaniel SP, Adeleye N. Environmental preservation amidst carbon emissions, energy consumption, and urbanization in selected african countries: Implication for sustainability.

J. Clean. Prod. 2021,

285, 125409. doi:10.1016/j.jclepro.2020.125409.

[Google Scholar]

67.

Tasnova N. The Impact of Bank Specific and Macroeconomic Determinants on Banks Liquidity: An Empirical Study on Listed Commercial Banks in Bangladesh. Doctoral Dissertation, Brac University, Dhaka, Bangladesh, 2021.

68.

Rahman MM, Alam K. Exploring the driving factors of economic growth in the world’s largest economies.

Heliyon 2021,

7, 1–9. doi:10.1016/j.heliyon.2021.e07109.

[Google Scholar]

69.

Ogbeifun L, Shobande OA. A reevaluation of human capital accumulation and economic growth in OECD.

J. Public Aff. 2022,

22, e2602. doi:10.1002/pa.2602.

[Google Scholar]