1. Introduction

In non-ecological contexts, such as the World Economic Forum, biodiversity loss is defined as one of the greatest threats to humanity and a driver for financial risk [

1,

2,

3]. In an ecological context, such as the Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services, the global assessment reports a decline in global wildlife populations coupled with the massive degradation of oceans, forests, freshwater bodies and other ecosystems [

4]. Such decline negatively affects nature’s resilience and capacity to support human activities. Therefore, it puts our economies and well-being at risk in ways that are difficult to model, due to uncertainties in ecological regime shifts and future policy trends [

5].

Nature degradation does not manifest itself as a systemic risk, as it does not threaten the very nature of the financial system. However, nature is increasingly becoming financially material to bankers, investors and insurers in the form of many risks and opportunities [

6]. Although there is an overall feeling that nature and finance are interconnected, the transmission channels through which nature loss and degradation can translate into financial risks are still fuzzy and remain fundamentally unexplored. Consequently, their mispricing by the financial sector and investee corporations leads to capital misallocation and exposure for the financial sector to financial-related risks [

7].

Embedding nature into the financial sector faces measurement and data standardization challenges. In particular, the issue of measurements (and therefore metrics) remarkably depends on which aspects of nature we deal with. For climate change mitigation, for instance, there can be a few agreed-upon metrics, such as greenhouse gas emissions and global temperature; but for biodiversity loss, there is no single agreed-upon set of metrics to measure impacts and dependencies. This is due to the complexity of ecological systems—with their multitude of ecosystems, species, and interactions—as well as the complexity of economic and financial systems, which involve sector-specific dependencies and impacts across supply chains. However, despite the complexity, there are transmission channels between biodiversity and finance. The interest in exploring such transmission channels is growing exponentially, as confirmed by the proliferation of studies that attempt to frame the problem and propose solutions [

7,

8,

9,

10,

11,

12]. Nevertheless, there can be very different perspectives in prioritizing what to focus on to solve the problem.

Let us consider, for example, the application proposed by the World Wildlife Fund. In their report on spatial finance [

13], the independent assessment of the location of a company or a country’s assets and infrastructure using ground data, remote sensing observations and modelled assessments is proposed as a means to generate improved quantitative insights into the finance sector. Specifically, when addressing how to compute a climate and nature sovereign risk [

14], they list a series of indicators: “biodiversity and natural capital” (such as land fragmentation and productivity), “atmosphere” (such as days of extreme heat and drought probability), “water” (such as projected sea level rise risk and freshwater withdrawal rates) “agriculture” (such as sustainable nitrogen management and global food security index). All indicators are important but disjointed from each other, and without any direct connection with financial instruments (a).

. The ‘black box’ clause in the assessment of the financial risks of biodiversity loss. (<b>a</b>) The natural metrics are explained, but the financial side remains unexplored. (<b>b</b>) The financial side is explained, but the natural metrics remain unclear.

As another example, we consider the applications proposed by Banque de France [

15], De Nederlandsche Bank [

16] and the World Bank [

17]. Policy makers and the supervisory authorities are becoming increasingly aware of the need for a stronger focus on financial risks related to the environment: such risks cannot be simply avoided; they need to be managed [

18]. There is an indirect and two-way relationship between biodiversity and financial institutions: the financial sector finances (i) companies that may be dependent on ecosystem services for the production of their goods and services, and (ii) companies that have an adverse impact on biodiversity through their production processes (). First on the dependency side, ENCORE

1 is used to assess the dependency on ecosystem services: this database, in the initial version used by [

15,

16,

17], assigns a score on the dependencies on 21 ecosystem services for 86 business processes, which are then linked to economic sectors; eventually, bank credit exposures to those sectors are estimated. Such estimates help assess banks’ exposure to sectors that are highly or very highly dependent on one or more ecosystem services. However, the scores simply assume that ecosystems are able to provide all the services needed, which is quite a strong assumption. Second on the impact side, selected indicators (such as the biodiversity footprint, the loss of species and populations in ecosystems or the companies that operate in protected areas and are involved in environmentally controversial activities) can provide insight on the impact of economic activities on biodiversity.

In both examples, we can record a sort of “black box” clause:

-

-

In the case of environmental NGOs, most of the attention is on the ecological side, and not much is explored on how the financial actors should use the selected indicators;

-

-

In the case of financial institutions, most of the attention is on how to calculate the financial exposure and not much is assessed on the ecosystem contribution side.

This makes perfect sense, considering the contexts these studies come from. Limitations of such approaches are clearly stated in each application:

-

-

It is difficult to measure biodiversity itself and to identify baselines from which to measure change. No unique indicator can comprehensively capture all dependencies and impacts on biodiversity. This is an issue of conceptual framework: the implications of biodiversity loss would need to be disaggregated into ecosystems and ecosystem services, which in turn necessitate being measured individually in order to be meaningful;

-

-

Ecosystems are complex and dynamic systems with tipping points, whose non-linear changes are hard to predict. It is argued [15,16,17] that knowledge of the interaction between ecosystem services and the economy is limited because there is no exhaustive overview of ecosystem services on which the economy depends and because it is difficult to quantify the impact of biodiversity loss on the supply of ecosystem services. This is an issue of assessment, and concerns specifically the operational procedures of “how” to estimate “which” ecosystem services;

-

-

The estimation of financial exposures by banks, insurance companies, pension funds and asset managers to the risks of biodiversity loss remains largely unexplored in the literature; in fact, each step of the transmission chain presents its own difficulties and obstacles. The assessment and modelling of the ecology-economy-finance transmission path is challenging because of the inherent complexity of each single phenomenon combined with the multiplicity of possible events and reactions, through direct and indirect effects.

This paper addresses the first limitation: the conceptual framework. In the following section, an approach based on ecosystem services is identified as a comprehensive solution to connect ecosystems to socio-economic systems in an ecologically meaningful and economically useful way.

2. The Conceptual Framework: Bridging Ecosystems and Socio-Economic Systems through Services and Vulnerabilities

A comprehensive framework cannot treat climate change, biodiversity, natural resources, pollution, and ecosystem services as separate and disconnected issues. Within a comprehensive framework, all these environmental issues should be part of the same “ecosystem asset”. The definition of “ecosystem asset” should capture all the dependencies and impacts that economic activities (and this explains why it is named “asset”) exercise on nature (and this explains why the specification is “ecosystem”). Dependencies and impacts can be identified, described and measured through a series of Ecosystem Services (ES), which represent the contribution of ecosystems to human activities and therefore the bridge capable of disentangling the complexity of the ecological domain into individual flows that fulfil specific uses for specific beneficiaries in the socio-economic domain. ES in fact supports economic activities in different ways [

19] and with a different scope for what concerns impact, dependency and the corresponding typologies of risks [

8,

20]:

- 1.

-

They act as ecological inputs (e.g., biomass formation, crop pollination, on-site soil retention) in economic production processes. All primary sector activities depend on them. The lack of these services may cause physical risks;

- 2.

-

They act to remove pollutants (e.g., air filtration, water purification, soil decontamination) generated by economic activities. Most of the primary and secondary sector activities, and part of the tertiary sector activities, depend on them. The lack of these services may result in transition risks related to regulations and penalties, as well as reputational risks;

- 3.

-

They act as protection against physical (flood and fire control), biological (pest control) and other risks. Almost all economic activities (including all human settlements) depend on them because of their geographical location. The lack of these services may cause physical risks;

- 4.

-

They act to support target compliance when it comes to overarching environmental targets such as climate change (e.g., carbon sequestration) and halting species extinction (e.g., habitat and species maintenance). Economic activities may generate an impact on them. The lack of these services may cause transition risks related to regulations, penalties, and reputational damage.

ES definition and classification evolved over time [

21,

22,

23,

24,

25]. Currently, the most complete and granular ES list available is provided by the Common International Classification of Ecosystem Services (CICES

2).

In order to explain how to move from conventional definitions in use for economic and financial transitions to a desirable comprehensive framework, this paper starts by exploring the terrestrial ecosystem component, and specifically “land” with respect to the agricultural sector. Specifically, an ES-based approach enables us to move from the notion of land, as a pure surface dedicated to primary production, to the notion of ecosystem assets, which are a source of many services for many beneficiaries. Land is a basic factor in agricultural production: if agricultural production decreases, then the value of land depreciates. Agricultural production can decrease because of inadequate soil management practices that remove topsoil, water scarcity and excessive pollution from nutrients or pesticides that become a liability for the owner and turn agricultural land into a stranded asset [

26]. Therefore, the general meaning of cropland (in terms of coverage and use) differs from the specific meaning of soil (in terms of organic material, minerals, and microorganisms) and the comprehensive meaning of ecosystem assets. To define the typology of land according to the destination of use and specific cultivations (a) differs from considering the cropland as an ecosystem that provides many services (b).

. From the concept of land use (<b>a</b>) to the concept of ecosystem asset (<b>b</b>).

Agriculture depends on many ecosystem services (). Biomass growth, soil retention, pollination, and water provision are key ecological inputs needed to sustain the agricultural production process (issue of sustainable use of natural resources). Water purification and soil decontamination are needed to remove the negative externalities generated by the agricultural production process (issue of pollution). Depending on where agricultural fields are located, flood control and fire control are additional services needed to receive ecosystem protection against physical threats, and the pest control service against biological threats (issue of climate change adaptation). These services are provided to agriculture not only by cropland and grassland but also by woodland, forests, and other vegetated land typologies. Agricultural activities depend on all these ecosystem services. In addition, management practices in agriculture can also affect carbon storage and sequestration, habitat and species maintenance and therefore have an impact on climate change and biodiversity loss (issues of climate change mitigation and biodiversity loss).

. The agricultural sector and its dependencies from and impacts on ecosystems through services.

Ecosystem services are key in measuring the resilience of agriculture and eventually, of the entire food system. Decreasing summer precipitation in southern Europe and rising temperatures (that enhance evaporative demand) lead to reduced soil moisture and more frequent and intense droughts. Green water is the moisture stored in the soil from rainfall. Most of global crop production relies on green water (two-thirds according to [

27]). Unsustainable agricultural practices cause the degradation of agricultural land because of excessively intense cultivation and inadequate soil management, whereby topsoil is removed, causing soil depletion and reduced crop yields. In addition, farmers have to manage production risks related to weeds, pests and diseases. A significant amount of potential crop production in the world is already lost annually (25–40% according to [

28]) and these losses could double without crop protection practices, such as integrated management systems based on host plant resistance and biological control. Finally, many farms can significantly reduce their CO

2 emissions through (for example) alternative management practices such as applying fertilisers, tilling the land, and feeding livestock. All these important environmental challenges could be addressed by improved agronomic efficiency. In fact, water control and soil moisture management could ensure adequate availability of moisture to plant roots. Optimal cropping pattern involves choosing the best varieties that align the harvesting calendar with moisture availability, sowing at the right time, and managing weeds, arthropod pests and diseases. A biodiverse agricultural crop base is more resilient to drought, flood, fires and pests than (for example) intensive monocultures. An ES-based approach enables the identification and measurement of all the ecological processes leading to crop yield, where human actions have an impact and generate an effect.

In determining whether an ecological process becomes an ecosystem service, it is important to consider that there are two interactive sides: an ecosystem potential and a socio-economic demand [

29,

30,

31]. When there is a match between ecosystem potential and socio-economic demand, then an ecosystem service is effectively delivered (a). However, there may be cases when there is a mismatch because ecosystems are not present or because they are too degraded to provide the needed service flow (b).

. Interaction between the ecosystem service potential and the socio-economic demand. The blue arrows indicate that the service flow (in (<b>a</b>)) or service vulnerability (in (<b>b</b>)) occurs as a result of this interaction.

Each time this kind of mismatch occurs, economic activities are exposed to ecosystem services vulnerability because the provision of services does not cover the demand for ecosystem services.

In creating a cause-and-effect relationship between the ecosystems and socio-economic systems, it is important to assess when ES cover human needs and when human needs remain uncovered. In a policy context, this would be an important information to understand where and how to act to make sure that the economic sector (in this case agriculture) is not exposed to ES vulnerabilities because it lacks ecological inputs (e.g., pollinator, unfertile soil); it lacks protection against the risks of flooding, landslides, fires and pest; it lacks the ecosystem cleaning of the negative externalities it generates ().

. Ecosystem services: matching and mismatching in transactions between ecosystems and socio-economic systems. The red dotted arrow shows the link between ecosystem services (flows or vulnerabilities) and the agricultural sector.

3. Discussion

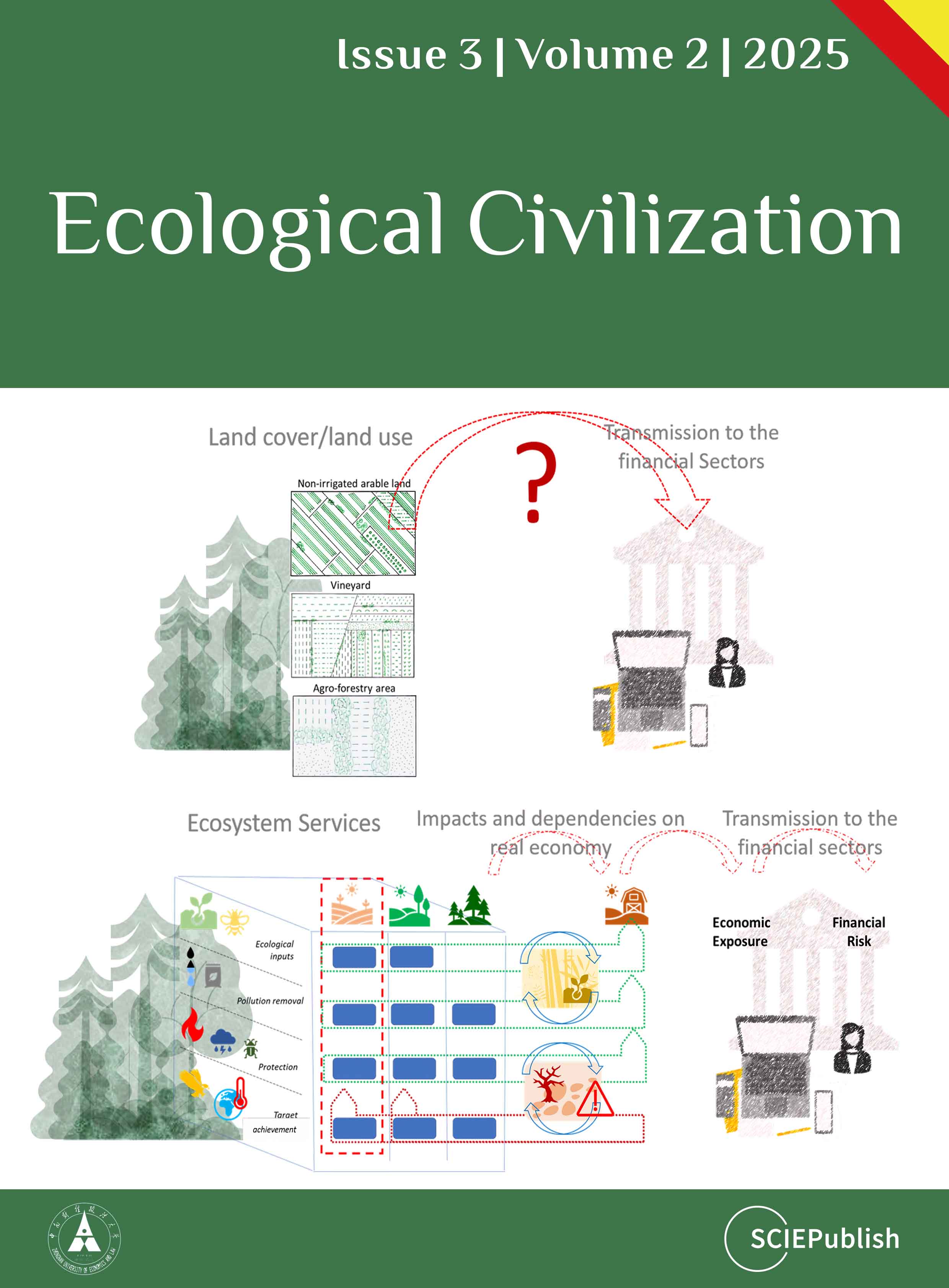

An ES-based approach can break the black box clause by disaggregating the metrics of nature and biodiversity into individual flows that connect ecosystems to socio-economic systems. The transactions from nature to economic users based on ecological processes enable the creation of a cause (ecosystems and their ability to provide services) and effect (the use of services by economic sectors and households) relationship that can be assessed quantitatively. However, as shown in , there are still many steps to take before fully uncovering the black box and obtaining a comprehensive understanding of the cause-and-effect relationships.

. The missing steps for a complete cause-and-effect relationship. The red dotted arrow shows that the link between ecosystem services (flows or vulnerabilities) and the agricultural sector is just the beginning of a series of connections that need to be investigated. These connections will reveal the impacts and dependencies with the real economy, which quantifies economic exposure, and the financial sectors, which quantify financial risk.

Transmission channels still need to be developed from an ecosystem services perspective, and in particular by considering the different roles (and associated vulnerabilities) through which they support economic activities. Although financial markets are not directly impacted by changes in ecosystem service provision, stresses in commodity markets can spread widely throughout the financial system. Commodities are real economy goods whose supply is finite and can therefore directly impact prices with respect to a short-term inelastic demand [

32]. Commodities markets involve a large number of interconnected participants, whose role and action need to be identified and framed by keeping a clear impact-dependency link with ecosystem services. In the case of the agricultural sector, the primary sectors support other sectors that transform, trade and sell the raw agro-biomass (the commodity) to final consumers. Each step of the process adds value to the raw agro-biomass, which at the end of the value chain proves to be a non-substitutable input.

On the financial side, some of the financial institutions will act on a macroeconomic perspective. For example, central banks implement monetary policy through credit operations and asset purchases. Credit operations indirectly expose central banks to ecosystem service vulnerabilities through the exposure of the financial institutions they lend; in fact, if some of them default, central banks are in turn exposed by holding their collateral. Asset purchases (both domestic and foreign) directly expose central banks to ecosystem service vulnerabilities through the assets they own in their monetary policy portfolios. Central banks could take into account stability concerns (e.g., related to climate change and biodiversity loss) when selecting economic activities to support with better financing conditions, choosing which assets to purchase and/or accept as collateral and to which loans to give access with targeted credit operations.

Some other financial institutions move from a macro to a micro-economic focus. For example, decreasing supply of certain agricultural goods can cause price rises, which in turn affect food and beverage companies. Companies can partly absorb such costs, which will result in reduced margins. Solutions are possible: new inclusive models of investment for local farmers support the combination of assets such as land, labour and local knowledge, with corporate investors providing financial capital, facilitating access to markets, and technology transfer. A few examples: investment funds for agriculture, with an emphasis on value creation through processing, logistical services and wholesaling, contract farming, lease and management contracts, tenant farming and share cropping, farmers’ organisations and cooperatives, and building upstream and downstream business links.

To suggest a comprehensive framework is only the starting point of a long learning journey whose urgency is felt from researchers and analysts from both the ecological and financial sides, whose work must unveil the black box in order to become effectively used.

Ethics Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Funding

This research received no external funding.

Declaration of Competing Interest

The author declares that she has no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.

Footnotes

- 1.

-

Ref. https://encore.naturalcapital.finance/en (accessed on 1 April 2025).

- 2.

-

Ref. https://cices.eu/ (accessed on 21 June 2023).

References

1.

World Economic Forum. Global Risks Report 2024. 19th Edition. Geneve, Switzerland, 2024. Available online: https://www.weforum.org/publications/global-risks-report-2024/ (accessed on 7 April 2024).

2.

World Economic Forum. Nature Risk Rising: Why the Crisis Engulfing Nature Matters for Business and the Economy. 2020. Available online: https://www3.weforum.org/docs/WEF_New_Nature_Economy_Report_2020.pdf?_gl=1*1o7bz13*_up*MQ..&gclid=Cj0KCQjwx5qoBhDyARIsAPbMagCwZCjTvJedBhjME9OuI_zJg2CNqEwujY7RKKiEY_fSUIUM7Nvw9ccaAoYLEALw_wcB (accessed on 17 September 2023).

3.

Granados Franco E, Kuritzky M, Lukacs R, Zahidi S. The Global Risks Report 2022, 17th ed.; World Economic Forum: Cologny, Switzerland, 2022.

4.

IPBES. Global assessment report on biodiversity and ecosystem services of the Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services. In IPBES Secretariat; Brondizio ES, Settele J, Díaz S, Ngo HT, Eds.; IPBES Secretariat: Bonn, Germany, 2019. doi:10.5281/zenodo.5517154.

5.

Dasgupta P. The Economics of Biodiversity: The Dasgupta Review. HM Treasury. 2021. Available online: https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/962785/The_Economics_of_Biodiversity_The_Dasgupta_Review_Full_Report.pdf (accessed on 13 May 2023).

6.

Mulder I, Clements-Hunt P. Demystifying Materiality. CEO Briefing. United Nations Environmental Program- Finance Initiative. 2010. Available online: https://www.unepfi.org/fileadmin/documents/CEO_DemystifyingMateriality.pdf (accessed on 13 May 2023).

7.

Organisation for Economic Co-operation and Development. Biodiversity, Natural Capital and the Economy: A Policy Guide for Finance, Economic and Environment Ministers. 2021. Available online: https://www.oecd.org/environment/biodiversity-natural-capital-and-the-economy-1a1ae114-en.htm (accessed on 13 May 2023).

8.

Cambridge Institute for Sustainability Leadership. Handbook for Nature-Related Financial Risks: Key Concepts and a Framework for Identification. 2021. Available online: https://www.cisl.cam.ac.uk/system/files/documents/handbook-for-nature-related-financial.pdf (accessed on 19 September 2023).

9.

G20 Green Finance Study Group. G20 Green Finance Synthesis Report; G20 Green Finance Study Group: Sanya, China, 2017.

10.

Network for Greening the Financial System. Nature-Related Financial Risks: A Conceptual Framework to Guide Action by Central Banks and Supervisors. 2023. Available online: https://www.ngfs.net/sites/default/files/medias/documents/ngfs_conceptual-framework-on-nature-related-risks.pdf (accessed on 12 May 2023).

11.

Network for Greening the Financial System. Central Banking and Supervision in the Biosphere: An Agenda for Action on Biodiversity Loss, Financial Risk and System Stability. 2022. Available online: https://www.ngfs.net/sites/default/files/medias/documents/central_banking_and_supervision_in_the_biosphere.pdf (accessed on 12 May 2023).

12.

Network for Greening the Financial System. Overview of Environmental Risk Analysis by Financial Institutions. Paris, 2020. Available online: https://www.ngfs.net/system/files/import/ngfs/medias/documents/overview_of_environmental_risk_analysis_by_financial_institutions.pdf (accessed on 12 May 2023).

13.

Patterson D, Schmitt S, Singh S, Eerdmans P, Hugman M, Roux A. Climate & Nature Sovereign Index. Introducing a Framework for a Clear Assessment of Environmental Risk. 2020. Available online: https://www.wwf.org.uk/sites/default/files/2020-07/Climate_%26_Nature_Sovereign_White_Paper.pdf (accessed on 12 May 2023).

14.

World Wildlife Fund, World Bank. Spatial Finance: Challenges and Opportunities in a Changing World. 2020. Available online: https://www.wwf.org.uk/sites/default/files/2020-12/Spatial%20Finance_%20Challenges%20and%20Opportunities_Final.pdf (accessed on 23 May 2023).

15.

Svartzman R, Espagne E, Gauthey J, Hadji-Lazaro P, Salin M, Allen T, et al. A “Silent Spring” for the Financial System? Exploring Biodiversity-Related Financial Risks in France (826. Working Paper Series). 2021. Available online: https://www.bruegel.org/sites/default/files/wp-content/uploads/2021/10/Presentation-by-Romain-Svartzman.pdf (accessed on 12 May 2023).

16.

van Toor J, Piljic D, Schellekens G, van Oorschor M, Kok M. Indebted to Nature Exploring Biodiversity Risks for the Dutch Financial Sector; De Nederlandsche Bank: Amsterdam, The Netherlands, 2020.

17.

Calice P, Diaz Kalan F, Miguel F. Nature-Related Financial Risks in Brazil; 9759; Policy Research Working Paper; World Bank: Washington, DC, USA, 2021.

18.

Schellekens G, van Toor J. Values at Risk? Sustainability Risks and Goals in the Dutch Financial Sector. 2019. Available online: https://www.dnb.nl/media/hm1msmzo/values-at-risk-sustainability-risks-and-goals-in-the-dutch.pdf (accessed on 23 May 2023).

19.

La Notte A. Greening finance and green financing need environmental metrics. The opportunities offered by natural capital accounts.

J. Sustain. Financ. Account. 2024,

3, 100013. doi:10.1016/j.josfa.2024.100013.

[Google Scholar]

20.

Clapp C, Lund HF, Aamaas B, Lannoo E. Shades of Climate Risk. Categorizing Climate Risk for Investors; CICERO Center for International Climate and Environmental Research: Oslo, Norway, 2017.

21.

de Groot RS, Wilson MA, Boumans RMJ. A typology for the classification, description and valuation of ecosystem functions, goods and services.

Ecol. Econ. 2002,

41, 393–408, doi:10.1016/S0921-8009(02)00089-7.

[Google Scholar]

22.

Haines-Young R, Potschin M. Common International Classification of Ecosystem Services (CICES) V5.1 and Guidance on the Application of the Revised Structure. 2018. Available online: https://cices.eu/content/uploads/sites/8/2018/01/Guidance-V51-01012018.pdf (accessed on 21 June 2023).

23.

Millennium Ecosystem Assessment. Ecosystems and Human Well-Being; Island Press: Washington, DC, USA, 2005.

24.

Newcomer-Johnson T, Andrews F, Corona J, DeWitt T, Harwell M, Rhodes C, et al. National Ecosystem Services Classification System (NESCS Plus); NESCS Plus; US EPA, Ed.; U.S. Environmental Protection Agency: Washington, DC, USA, 2020. Available online: https://www.epa.gov/eco-research/national-ecosystem-services-classification-system-nescs-plus (accessed on 21 June 2023).

25.

TEEB. Ecological and Economic Foundations; Edited by Pushpam Kumar. Earthscan: London and Washington. 2010. Available online: https://teebweb.org/publications/teeb-for/research-and-academia/ (accessed on 21 June 2023).

26.

Caldecott B, Howarth N, McSharry P. Stranded Assets in Agriculture: Protecting Value from Environment-Related Risks. 2013. Available online: https://www.smithschool.ox.ac.uk/sites/default/files/2022-03/stranded-assets-agriculture-report-final.pdf (accessed on 23 May 2023).

27.

Food and Agriculture Organization of the United Nations, International Fund for Agricultural Development, United Nations International Children’s Emergency Fund, World Food Programme, World Health Organization. The State of Food Security and Nutrition in the World 2021. Transforming Food Systems for Food Security, Improved Nutrition and Affordable Healthy Diets for All; FAO: Rome, Italy, 2021. Available online: https://www.fao.org/3/cb4474en/cb4474en.pdf (accessed on 21 June 2023).

28.

Food and Agriculture Organization of the United Nations. The State of the World’s Land and Water Resources for Food and Agriculture—Systems at Breaking Point. Main report. 2022. Available online: https://www.fao.org/3/cb9910en/cb9910en.pdf (accessed on 23 May 2023).

29.

Burkhard B, Maes J. Mapping Ecosystem Services. In Advanced Books; Pensoft Publishers: Sofia, Bulgaria, 2017.

30.

La Notte A, Vallecillo S, Marques A, Maes J. Beyond the economic boundaries to account for ecosystem services.

Ecosyst. Serv. 2019,

35, 116–129. doi:10.1016/j.ecoser.2018.12.007.

[Google Scholar]

31.

Wolff S, Schulp CJE, Verburg PH. Mapping ecosystem services demand: A review of current research and future perspectives.

Ecol. Indic. 2015,

55, 159–171. doi:10.1016/j.ecolind.2015.03.016.

[Google Scholar]

32.

Basel Committee on Banking Supervision. Climate-Related Risk Drivers and Their Transmission Channels. 2021. Available online: https://www.bis.org/bcbs/publ/d517.pdf (accessed on 22 September 2023).